As several people have pointed out over the past few weeks in relation to the Water Street debt reduction millage which was recently defeated at the polls, the people of Ypsilanti already pay a much higher tax rate than those who live elsewhere in the region. In hopes of finding out why that is, I thought that I’d ask a few folks who I thought might be able to offer some insight. What follows is my conversation with former Ypsilanti City Planner Richard “Murph” Murphy, Ypsilanti Director of Economic Development Beth Ernat, and Ypsi City Council member Brian Robb.

As several people have pointed out over the past few weeks in relation to the Water Street debt reduction millage which was recently defeated at the polls, the people of Ypsilanti already pay a much higher tax rate than those who live elsewhere in the region. In hopes of finding out why that is, I thought that I’d ask a few folks who I thought might be able to offer some insight. What follows is my conversation with former Ypsilanti City Planner Richard “Murph” Murphy, Ypsilanti Director of Economic Development Beth Ernat, and Ypsi City Council member Brian Robb.

MARK: As of right now, what can the typical Ypsilanti homeowner expect to pay in the way of taxes? For the purposes of our discussion, let’s assume we’re talking about a house that someone just purchased this past year for $100,000.

MURPH: A homeowner in City of Ypsilanti pays 35.0727 mills in City taxes. This includes the general operating millage and the dedicated millages: transit, sanitation (trash/recycling), police and fire protection, and local street repair bonds. Ypsilanti homeowners also pay another 32.4252 mills to other various entities including Washtenaw County, Ypsilanti Community Schools (YCS), the Ypsilanti District LIbrary (YDL), the Washtenaw Intermediate School District (WISD), the Ann Arbor Area Transportation Authority (AAATA), Washtenaw Community College (WCC), and the state education fund. [Source: City of Ypsilanti Treasurer.]

MARK: So, when you add it all up, what does that come to?

MURPH: 1 mill = $1 per $1,000 of taxable value. And the taxable value of a property is assessed at half of “market” value. So your hypothetical homeowner, who purchased a property for $100,000, would be taxed based on a value of $50,000… Here’s the math:

$50,000 / 1,000 * (35.0727 + 32.4252) = $3,374.74 in taxes.

MARK: So, if you just moved to Ypsilanti this year, and paid $100,000 for a home, you should expect to pay 3,374.74 in taxes your first year?

MURPH: Yes, and someone who has owned their home longer would pay less, because a property’s taxable value doesn’t rise as fast as its market value… It might also be worth noting that rental property anywhere in the State pays an extra 18 mills.

MARK: And how does that stack up against communities elsewhere in Michigan?

MURPH: It depends on who you’re comparing us with. Within Washtenaw County, Ann Arbor residents pay 16.3003 mills to the city + 25.8754 mills to other entities, or 42.1757 mills total. So, if by some miracle, you found a $100,000 house in Ann Arbor, you’d pay $2,198.79 in taxes. Using Zillow’s numbers for median home value in each city, though, the median new homeowner in Ann Arbor will pay $6,705.94, vs. the median new homeowner in Ypsilanti paying $4,606.73. Saline has 16.28 local mills, and 45.0289 mills total, so a median new homeowner there would pay $5,108.53.

MARK: So, while it’s true that our tax rate is higher in Ypsilanti, it’s also true that, on average, we pay less in taxes than elsewhere in the county, given that houses here tend to sell for less.

MURPH: Yes, but people are right when they say that Ypsilanti has among the highest local millage rates in the state. It’s also true that Washtenaw County has higher than average taxes.

MARK: And it’s not just Saline and Ann Arbor that we’re higher than. Online, in a recent discussion about our Ypsilanti tax situation, someone posted the following: “Not everyone is willing to live in hipsterville if they can move a block out of the city and pay $600 less a year in taxes.” Leaving aside for a moment his comment about “Hipsterville”, the person who wrote this is correct about the significant tax savings that can be had by purchasing a home in Ypsilanti Township, just a few feet outside of the city, right? What accounts for that difference between city and township taxes?

BRIAN: Well, there are structural reasons why the millage rate is high in the city, but the high millage rate is also due to decisions we’ve made as a community.

Somewhere in the distant past, voters adopted a fire and police pension millage that will be 7.8415 mills in FYE 2017. And, in 2001, the voters passed a road millage that will account for 4.5866 mills in FYE 2017. And, in 2010, we overwhelming supported a 0.9789 mill increase for public transit. If we pass the Regional Transit Authority (RTA) and Washtenaw County road millages this November, we’ll be adding another 1.7 mills to our annual tax bills.

Some of those decisions were questionable. For example, back in 2004, City Council adopted new fire and police labor contracts that increased the retirement multiplier from 2.5 to 3. The Council seated at the time made this change retroactive. Not to get into the weeds too much, but, in 2003, the fire and police pension was overfunded by $4.9 million. In just two years, the system was underfunded by $1.6 million. That’s a swing of $6.5 million. Today the pension is underfunded by more than $15 million. That’s the biggest reason our millage rate has increased from 1.7197 in FYE 2005 to 7.8415 in FYE 2017. Given the opportunity, I’d like to think the Council, as currently constructed, would not make that same mistake.

You could also argue the road bond was a poor decision. The local streets were allowed to deteriorate to the point they all needed replacing at the same time. The road bond millage raised $16,930,000. The problem is that money was all in-hand at once, but the construction couldn’t all be done at the same time. As a result, a significant portion of that revenue was used to pay interest on the debt resulting in a higher millage rate. It was important to fix the roads, but the millage as executed was the wrong mechanism. Again, I would like to think the Council, as currently constructed, would not make that same mistake if given the opportunity.

MARK: So it’s not just that we’ve got an aging city, and state revenue sharing is drying up… You’re suggesting that, to some extent, our current tax rates can be attributed to poor decisions in the past.

BRIAN: Right, but it should also be noted that Council has done some good things that are saving us money. The transportation millage of 2010, for instance, was a genius creation thought up by Council member Murdock. It preserved busing and led to the City (and eventually the Township) joining the AATA. And, ultimately, it led to the expansion of bus service throughout the AAATA service area.

BETH: I would also add that, in Michigan, we’re living in an era of al la carte government. With reduced overall revenue sources, city governments no longer determine the types of services that are offered. Instead, the services are dictated by millages decided by the people. As was mentioned earlier, the voters decide what types of transportation services are available, if parks are created, and if recreation services are offered. Voters also decide how they fund employee pensions, as well as what types of police, fire, and ambulance services are available. In the past, when revenues were available, all of these services had been provided for by our traditional cities. That was the main difference between city and township types of government. The urbanized cities had transportation, parks and recreation, libraries, arts and culture, sidewalks and paved streets. In today’s economy, what you get is dependant on how many mills a city or township can change, and what the voters choose when the options are provided.

MARK: Murph, do you have anything to add on the subject of why our tax rate is so high in the City of Ypsilanti? Are there statewide patterns that we should be talking about?

MURPH: Yes, Brian mentioned “structural reasons,” and a lot of this has to do with the dynamics we’re seeing statewide – Ypsilanti is not unique. Look at SEMCOG’s report “Running on Empty” from 2014, or Michigan Municipal League’s “SaveMICity” website, especially the report “Michigan’s Great Disinvestment” by the former head of the Michigan House Fiscal Agency. Both of these outline the fiscal straitjacket that Michigan has put local communities in, especially with the combination of the Headlee Amendment and 1994’s Proposal A. (For transparency, MML is my employer.)

The big takeaway from those is that, no matter how fast home values go up, or how many new businesses open downtown, cities’ property tax revenues can only go up by the rate of inflation every year. Which means, in real dollars, the revenue the city collects from an existing millage never goes up. In a down market, though, it can drop 5%, 10%, whatever in a year – there’s no floor, and then the cap is reinstated at that lower level. The only way around this is new construction, or new millages.

MARK: And this is exacerbated in Ypsilanti because so much of our property is owned by non-tax-paying entities.

MURPH: Yes, we’re hindered by the amount of non-taxable property we have: state and county offices on Michigan Ave, the school properties, the churches, parks, etc. Our taxable value per capita is a lot lower than some nearby communities, so we have to pay higher rates to get the same revenue. And we have to provide services to those destinations (police and fire protection, maintaining roads for traffic to them, etc.) but they don’t bring in income. (The state is supposed to reimburse locals for fire protection to state-owned properties, but they’ve been shorting those payments by about 50% for over a decade.)

Many cities host non-taxable regional destinations, but EMU’s campus is our unique piece, for how big a portion of the city it takes up. In bigger college cities like Kalamazoo or Ann Arbor, the much larger size of the city reduces the impact of campus some. In other small college towns like Albion or Big Rapids (Ferris State) where the campus makes up a similarly large part of the city area, they use income tax to make up the difference.

BETH: Adding on to what Murph is saying, we should also note that EMU is our biggest economic development opportunity. The school creates jobs in the city and region, provides education, and generates traffic All three of those items are necessary when building a business ecosystem in a community. However, EMU does account for 40% of the land area in the city. And, if you include the schools and other non-tax paying entities in the community, the tax base is reduced by another 10%, bringing the total to 50%. All of these entities still require city services, police, fire, roads and plowing. The tax rate is based on the 100 percent of the City, therefore, the other taxpayers have to make up the difference in their taxes. When there are more taxpayers, the tax burden on individuals is spread more evenly.

MARK: Speaking of schools, we should probably acknowledge the fact that home value to a large extent is a function of a school district’s perceived quality, correct?

MURPH: Yes. When the County did their regional equity analysis a year or two ago, and the consultant was pressed about the potential impact of schools, he gave an off-the-cuff estimate that putting Ypsi into the Ann Arbor school district would “overnight” raise the value of every residential unit in the Ypsi school district by $10k-$40k, just from the relative perception of the school districts.

The schools are also a factor in terms of the value of individual properties. Homebuyers pay for perceived school district quality–often even if they don’t have kids themselves. When I try to recruit friends to move to Ypsilanti, local complaints like taxes or crime fears are never the deal breaker for them–they move to Ann Arbor or Saline for the school district. It’s probably the biggest factor in why Saline’s home prices are nearly twice Ypsi’s, feeding that taxable value per capita equation.

MARK: OK, let’s talk a little more about the effects of Proposition A and the Headlee Amendment on aging cities like Ypsilanti.

BRIAN: Prop A and Headlee are killing everyone… not just those of us in aging cities. After the housing crash, the City lost 35% of its property tax revenue in two budget cycles. Even as values continue to rise, our tax revenues barely increases. Taxable value cannot increase more than the lesser of 5% or the rate of inflation. Last year the assessment on my house went up over 10%, but my taxable value only increased by 1.5% (compared to less than 0.5% city-wide). At it’s peak, my house had a taxable value of $60,900 in 2008. If my taxable value increases 1.5% a year, it will take until 2044 until my house has the same taxable value as before the crash.

MURPH: Right, Headlee and Prop A hit everybody, and the only way around those limits without adding millages is new construction. That’s where older, “built-out” cities face an extra challenge: they don’t have farmland to build on in order to add that new construction taxable value; they have to try to upcycle existing properties, and deal with the brownfield and other challenges that come with that. (This is where Water Street came from.)

MARK: As an illustration of that, I’ve heard that property tax revenues only went up something like $11,000 in fiscal 2016, right?

BETH: To start with, property taxes are always calculated one year in arrears. So when we are discussing this year, the 2016 fiscal year, we are working off of 2015 taxes. The tax increases for 2016 are minimal to the City revenue, but they show a better fiscal vision of the future than not. As with any loss, the rebuild will take significantly longer. The 2008 downturn and recession was partly caused by overinflated property values. The creep in tax revenues is a more realistic outlook on where the property tax revenues should be. That being said, it does not help the City and the financial realities of provided services without an increasing revenue stream.

MURPH: And even when a property sells, and the taxable value “pops up” under Proposal A, that doesn’t yield an increase in revenue for the city. Under Headlee, the city’s revenue is still capped, so having properties pop up during sales means the millage rate has to be reduced to keep revenues at the rate of inflation. The good news there is that having property values increasing and lots of properties selling at those higher values will reduce the tax rate…but not increase the city’s budget.

MARK: Let’s jump back for a minute and talk a little more about revenue sharing from the state. How have things changed on that front over the past few decades?

MURPH: Over the years, the State of Michigan has strictly limited local communities’ options for raising revenues; in exchange the state was supposed to provide funding through “revenue sharing”. The idea was that the state would take care of collecting funds and then distribute them out to the locals, and be more efficient than having the locals collect these taxes. Starting in 2002, though, the state has gone back on those promises, and hasn’t paid the full amount in any year since then. From then until 2015, the state has shorted the City of Ypsi by about $10.5 million in total. Currently they’re shorting Ypsi about $1.26 million / year–which would be more than enough to cover the Water Street payments. (MML has a calculator online that you can look up other cities.)

For more on this, see Citizens Research Council’s 2015 report, Reforming Statutory State Revenue Sharing, especially the section “Promises Made” starting on page 15.

MARK: As one of you mentioned earlier, the only real option to increase your tax base in a significant way is through new construction, which Michigan’s older cities, like Ypsilanti, can’t easily do, given that we don’t have a lot green space to expand into.

BETH: Yes, this is true. Ypsi only has about a dozen greenfield sites, if that. We have no room for expansion or mega subdivisions. Industrial parks and properties are also great ways to increase the tax base and diversify the tax base. Cities that have had long term success through many economic downturns tend to have diversified tax bases, that is the right mixture of commercial, industrial, multifamily and single family. However, older cities prided as bedroom communities and communities with industrialized niches have been hardest hit by revenue sharing, reduction/elimination of personal property tax, and Michigan’s overall tax structure.

MARK: And, it’s probably worth noting, this is why, a few decades ago, our Mayor and City Council decided that, as we didn’t have large parcels of development-ready property available, we should buy-out the largely industrial businesses on Water Street with the intention of bringing new, higher-value construction downtown…

MURPH: That’s my understanding, yes – as early as the mid-80s, the city was looking at Water Street as an opportunity to replace blighted, low-value property with higher value development. (See the 1985 comprehensive development plan for that era’s version of the project.) I wasn’t around for the first 20-some years of discussion, though, so can’t say well what other motives were there or how the plan evolved during that time.

Because construction is the only way to grow revenue, and Ypsilanti doesn’t have miles of cornfields to build on, Ypsilanti does need to support “up-cycling” of properties – but Water Street demonstrates the risk in having the city manage land assembly, and in having that done in such large chunks.

MARK: So, where does that leave us, especially relative to the Water Street debt, which is going to require that we start paying something on the order of $700,000 a year. I’ve heard from a number of people that they’d like to support a millage, so that we can pay off the debt, but they’re afraid that, by doing so, we’d discourage new home ownership in the city, as “the taxes are already too damn high.” What’s the solution?

MURPH: Good question. If no new millages, cuts are the easiest fix to think up, and probably need to be a part of a solution. Some things might also be restructured or done differently–there was a discussion of combining police and fire into a public safety department a few years ago, and before that there was an analysis of using the County Sheriff instead of a standalone police department; I don’t know if either of those offered significant savings, but it might be time to revisit those ideas.

I’d most like to see us think about development as a way to increase the revenue per mill, though. Water Street is obviously a big part of that, and the city has other vacant properties available for sale. Somehow finally getting the Ford plant owners to do something with that 80 acres would be good. Getting revenue up and tax rate down probably needs a lot of small projects to happen too, though. The new neighborhood enterprise zone to help support reinvestment in the neighborhood south of Michigan Avenue was a great step in that direction. We’re still limited by lack of vacant land, as Beth noted, and with most of our taxable land area limited by zoning to single-family homes, there’s only so much upcycling we can do – it takes a lot of people doing $50k additions on their houses to create significant new revenue.

[note: If you’re interested, our last conversation about the Headlee Amendment and Prop A, can be found here. And, if you want to make your own “too damn high” image, you can do so with the Jimmy McMillan meme generator.]

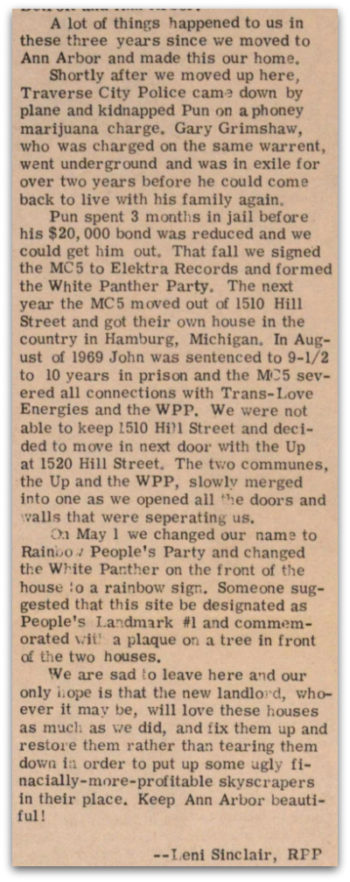

To give you a sense of what was happening at the time in Ann Arbor, here’s a clip from a September 4, 1971 article written by Leni Sinclair for the Ann Arbor Sun, the anti-establishment newspaper of the White Panther Party. [See right.] At the point this article was written by his wife and collaborator, John Sinclair was a little over two years into his ten year prison sentence. Little did anyone know, just a few months later, thanks in large part to the intervention of John Lennon, who had come to Ann Arbor to appear at the now legendary John Sinclair Freedom Rally, the Michigan Supreme Court would step in and order that Sinclair be released. Here, with more on that, is a clip from a much more recent article, also written by Leni Sinclair on the subject of their legal troubles at the time.

To give you a sense of what was happening at the time in Ann Arbor, here’s a clip from a September 4, 1971 article written by Leni Sinclair for the Ann Arbor Sun, the anti-establishment newspaper of the White Panther Party. [See right.] At the point this article was written by his wife and collaborator, John Sinclair was a little over two years into his ten year prison sentence. Little did anyone know, just a few months later, thanks in large part to the intervention of John Lennon, who had come to Ann Arbor to appear at the now legendary John Sinclair Freedom Rally, the Michigan Supreme Court would step in and order that Sinclair be released. Here, with more on that, is a clip from a much more recent article, also written by Leni Sinclair on the subject of their legal troubles at the time.