I’ve been thinking about Michigan prisons quite a bit lately. It seems as though, all of a sudden, the subject is everywhere… The University of Michigan’s annual exhibition of art by Michigan prisoners opened today. There’s an article on the Daily Kos this evening about how, under Governor Snyder’s Emergency Financial Manager plan, non-elected officials could make the decision to privatize our jails. And, as I mentioned in my last post, prisons came up a few times in last night’s community forum with State Senator Rebekah Warren. For those of you that didn’t watch the video clips attached to my last post, here’s what Warren said concerning prisons during last night’s Q&A.

I’ve been thinking about Michigan prisons quite a bit lately. It seems as though, all of a sudden, the subject is everywhere… The University of Michigan’s annual exhibition of art by Michigan prisoners opened today. There’s an article on the Daily Kos this evening about how, under Governor Snyder’s Emergency Financial Manager plan, non-elected officials could make the decision to privatize our jails. And, as I mentioned in my last post, prisons came up a few times in last night’s community forum with State Senator Rebekah Warren. For those of you that didn’t watch the video clips attached to my last post, here’s what Warren said concerning prisons during last night’s Q&A.

WARREN: (Reading a question submitted by a member of the audience) “Please elaborate on the $1.9 billion spent on prisons vs. the $1.2 billion on higher ed. Could this be true? It sounds outrageous.”

(Responding) It’s absolutely true. Michigan has the dubious distinction of being one of just four states in the nation that spend more on corrections than they do on higher education…

All of our corrections funding comes out of our general fund – our most flexible dollars – that could go to any program that we think is important. It doesn’t come in a silo from Washington, that has to go to one specific program or another. Corrections now eats up almost a whole quarter of our entire general fund budget. Michigan spends way more on corrections than most of our other Great Lakes States neighbors do. We put people in prison for longer sentences, for the same crimes. Michigan has interpreted truth in sentencing to mean that you are not eligible for parole until you have hit 100% of your minimum sentence, whereas under federal law, and in many other states, it’s 85% – if you’ve done the coursework that you’re supposed to do, whether it’s anger management, or substance abuse counselling, or whatever it is that you need to do to be a model prisoner – you could be considered for parole at 85% of your sentence. What we find in Michigan is, because of some challenges in the parole system, most of our prisoners are serving 120% of their minimum required sentence. And, so, that cost for us, depending on what facility they’re in, is between $35,000 and $50,000 per year, per prisoner.

There are a lot of recommendations that have come to the legislature that say, we need to do away with some of our mandatory minimum sentences that we instituted in the ’90s, when we got ‘tough on crime’ like a lot of other folks… We locked up first time drug offenders that were pretty small offenders, even if they were non-violent. We locked them away for life in prison, or certain mandatory length sentences… We have to decide who it is that we’re really afraid of. Public safety has to be paramount – it has to be the number one thing we look at when we talk about corrections funding – but for the folks we’re just mad at, that weren’t violent offenders, that really needed treatment more than they needed prison, we have a lot of alternatives now in community corrections and in tether technology. We’ve gotten so advanced in tether technology that we could be getting folks out of our corrections system, and have them back in the community, hopefully working, and paying restitution, if that’s what they’ve been ordered to do, and taking care of their family, and their child support obligations if they have them, and really becoming part of society, instead of us spending $50,000 a year to keep them in prison.

There are a lot of reputable organizations that have said there are at least $400 or $500 million in corrections reform that would really be relatively easy. And that’s the kind of Michigan that I want to see, where we’re smart on corrections policy, and not just tough on crime… and that we’re protecting public safety, but that we’re doing in such a way that we’re not spending more on corrections than we are on higher education…

So, who out there thinks that, if for-profit corporations came in to run our prisons, they’d aggressively move to decrease the length of sentences served, saving Michigan’s tax payers hundreds of millions of dollars?

Yeah, that’s what I thought.

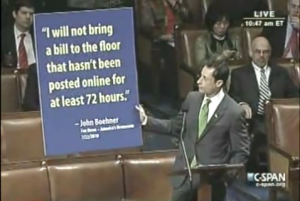

Oh, while I’ve got your attention, I wanted to mention that the Daily Kos piece I linked to above not only touches on the possibility that Michigan’s emergency financial managers could privatize our jails and police forces (buy that Blackwater stock), but also gets into a bit of background on the American Legislative Exchange Council (ALEC) – the corporate front group that many seem to think is supplying the Snyder administration with its ideas. Here’s a clip.

1. State legislators who pay $50 per year in dues and in exchange get junkets to luxury resorts, free or heavily subsidized vacations for their families, and other fringe benefits including free child-care and medical tests, Broadway shows, and dinners at expensive restaurants. ALEC’s membership includes 2,400 state legislators, which is over 30% of all state lawmakers in the country.

2. Over 300 corporate sponsors who pay up to $50,000 per year in dues plus up to $5,000 to sit on industry-specific task forces in their areas of interest such as energy, healthcare, telecommunications and taxes. The task forces write and approve the model legislation that conforms to the business interests of their corporate members. Tax records indicate that corporations collectively pay as much as $6 million a year. The corporate executives and their lobbyists then get substantial face time with the state legislators at ALEC’s retreats and other events.

According to its website, the corporate funders currently on ALEC’s Private Enterprise board include Koch Industries, Altria, Pfizer, GlaxoSmithKlein, Pfizer, Reynolds American Inc. (the parent company of cigarette maker R.J. Reynolds), Energy Future Holdings, Peabody Energy, PhRMA, AT&T, UPS, Wal-Mart Stores Inc., and State Farm Insurance…

What could possibly go wrong?

In all seriousness, why aren’t the Michigan Democrats pushing an alternative budget that focuses on the closing of corporate tax loopholes, prison reform, and the passage of a graduated, progressive income tax? I’ve got to think that a majority of Michiganders would prefer that to increasing taxes on the elderly and the working poor.