If you read this site, you know the Republican tax bill is shortsighted, cruel and stupid. You know that, even though it was sold to us as a middle class tax cut, the truth is, tax cuts for the middle class are small and temporary, while the tax cuts for billionaires and corporations are large and permanent. You know that, if passed in its most current form, the Republican tax plan would, among other terrible things, add nearly $1.5 Trillion to the national debt, raise taxes on the middle class, take health care from 13 million Americans, decimate higher education, and, through the elimination of the estate tax, pave the way for development of a true American aristocracy.

The question is, what can we do to stop it, now that it appears as though the Republicans may have the votes they need to pass it into law.

Before we get to that, though, here’s where we stand right now, process-wise… The House version of the bill, as you may recall, passed several weeks ago, meaning that the battle has transitioned to the Senate, where it looks as though Republicans have finally started to convince themselves that passing something – even a bad bill that fucks a majority of their voters – is better than passing nothing at all. [They haven’t, after all, passed a single piece of legislation into law over the past year, even though they’ve had control over the House, the Senate and the White House.] And, of course, as we’ve discussed before, their donors have made it clear that they won’t continue to write checks unless this is done. [The Republicans in Congress have admitted as much.] So, given all of that, the Senate version of the bill just passed through the Senate Budget Committee this afternoon with a 12-11 vote along party lines. Ron Johnson of Wisconsin and Bob Corker of Tennessee, both of whom had threatened to oppose the bill, ended up voting to pass it out of committee, moving it to the floor of the Senate, where it’s expected that there will be a vote Wednesday on whether or not to proceed. Assuming a majority vote to proceed, members of the Senate can then begin offering and debating amendments to the bill. And, if all goes according to the Republican plan, there could be a final vote as early as Friday. If they don’t get it done on Friday, though, they still have approximately one week. If they miss that window, though, they might be sunk, as it looks as though we might be facing a government shutdown on December 8. And, on December 12, assuming the people of Alabama decide to do the right thing and vote for the non-pedophile on the ballot, the dynamics of the Senate could be considerably different. [If you can, please consider joining me and sending a few dollars to Doug Jones, the man opposing Roy Moore in that incredibly important Senate race.]

So, now, here are a few things you can do right now.

1. Wherever you live, log into Indivisible’s new Trump Tax Scam site, which is full of great, state-specific information and resources, and start making calls to the offices of your Senators using their cal scripts.

Here, to give you an idea of what you’ll find when you visit the site, is what they have to say about Michigan, where I live.

[Just follow the “Michigan” link above, and you’ll find information like what’s above about your state, but with clickable links, call scripts, and any number of other cool, helpful tools and resources. If you want, they’ll even give you the number of a left-leaning person in a state with Republican Senators, so you can encourage them to call their offices.]

Remember, nothing is as effective as calling the offices of your elected officials, except maybe showing up in person… Speaking of which, the arrests in DC have already begun.

#BREAKING: Protesters disrupting Senate Budget Committee hearing #GOPTaxScam #NotOnePenny pic.twitter.com/nx0J0LcMGv

— AmpliFire News (@amplifirenews_) November 28, 2017

And, remember, just because you live in a state that has Democratic Senators, doesn’t mean you shouldn’t be making calls, either to your Senators, demanding that they do more to slow the progress of the bill, or to your friends and family members in other states, asking that they place calls to their Senators. Try minute you spend on the phone today will make a difference.

2. Go on Facebook and post the following question: “Who do I know in Arizona, Maine, Tennessee, Montana, Wisconsin, or Alaska?”

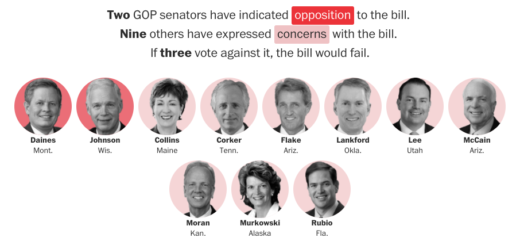

Then, when you start hearing back from people in those states, explain to them what’s at stake, and ask that they please take a minute and call the offices of John McCain (Arizona), Jeff Flake (Arizona), Susan Collins (Maine), Bob Corker (Tennessee), Steve Daines (Montana), Ron Johnson (Wisconsin) or Lisa Murkowski (Alaska). There are other Republican Senators that might be in play as well, as you can see from this new Washington Post graphic, but these are the seven that I’m focusing on, given what they’ve said on the record about their reservations concerning either the bill itself, the shady process whereby it came to the Senate floor, or the fact that it raises the deficit. [McCain, for instance, has said that he would vote against any bill that didn’t follow “regular order,” which this bill surely hasn’t. So Im encouraging everyone I know in Arizona to remind him of this fact.] And, remember, we just need three of them to flip, like McCain, Murkowksi and Collins did during the health care debate, to make this whole thing crumble. [I should add, I’m not adverse to comprehensive tax reform. I think it could be a good thing. I just think this particular bill is terrible is terrible for the working men and women of our country.]

[Just follow the “new Washington Post graphic” link above to be taken to the interactive series of graphics, which will show you what each of these Senators has said on the record about this bill on which they’ll be voting.]

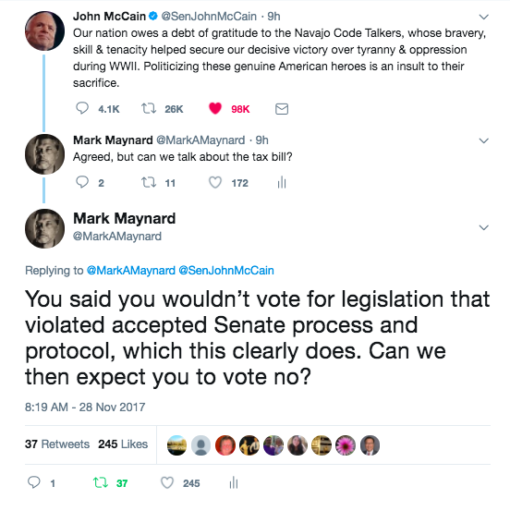

3. Troll the Senate Republicans mercilessly on social media.

It may not be as effective as a polite but forceful call placed by a constituent, but, after doing everything else that needs to be done, I’ve found it cathartic to just spend a few minutes on Twitter, reminding folks like Bob Corker what they’ve said in the past about how they’d never vote in favor of a tax bill that would raise the deficit, etc. [The non-partisan Congressional Budget Office has forecasted that the Republican tax bill, if passed into law, would increase the federal deficit by $1.4 Trillion over 10 years.] Here, to give you an idea as to how I’ve gone about it, is something that I tweeted to John McCain earlier today. [He’s yet to respond.]

4. Ask Resistbot for assistance.

I know calls are more effective than emails and texts when it comes to things like this, but I signed up for Resistbot earlier today, and it helped me to shoot out a few messages to my Senators. So, if you can’t make calls, and you have access to a smartphone, give it a shot. Here, if it helps, is what I sent out. [If I were to do it again, I’d explicitly ask for them to “withhold consent” to slow down the process, as was a tactic used effectively during the last health care fight. And, of course, I’d correct the grammar.]

5. Just talk with people.

It’s probably a good thing to do anyway, right? We should all be talking more. And not just with people we already know. We should be more open to conversations about these things. And we should be ready, when opportunities present themselves, to share facts about what’s going on. And, in this case, it’s really not all that hard, as the facts are on our side. The middle class tax cuts are temporary. The corporate tax cuts aren’t. It’s that simple. They’re lying to us, and they’re raising our taxes in order to hand over billions of dollars to America’s most wealthy. It’s that simple… So, if you’re at the barbershop today, standing in line at the grocery store, or picking your kid up from school, and you see an opportunity to mention what’s going on, give it a shot. Sure, it could lead to an awkward conversation with a Fox News watcher, but we owe it to future generations to at least try, right?

If you have other ideas for how people can get involved, please leave a comment. And, if you feel so inclined, please share this link on social media.

20 Comments

This quote from the Washington Post sums things up nicely.

“By 2019, Americans earning less than $30,000 a year would be worse off under the Senate bill, CBO found. By 2021, Americans earning $40,000 or less would be net losers, and by 2027, most people earning less than $75,000 a year would be worse off. On the flip side, millionaires and those earning $100,000 to $500,000 would be big beneficiaries, according to the CBO’s calculations.”

I call and complain to politicians from anywhere and everywhere. These shameless politicians accept political donations from anywhere and everywhere. They don’t restrict where they accept money from. So they shouldn’t restrict from where a citizen gives them voting instructions from. Besides, the votes these jokers make, no matter how remote these clowns are, will affect me. So I want a say.

They don’t mean it when they talk about the deficit. They don’t care if it goes up. In fact, they want it to go up, so they can then use the deficit to justify cuts to entitlement programs.

https://mobile.twitter.com/KrangTNelson/status/933058929076170754

“american politics is a sophisticated balancing act where once a month the government tries very hard to kill you and then you have to call a bunch of people and sternly ask them not to”

Bloomberg: “Trump’s Tax Promises Undercut by CEO Plans to Reward Investors”

Read more:

https://www.bloomberg.com/news/articles/2017-11-29/trump-s-tax-promises-undercut-by-ceo-plans-to-reward-investors

Washington Post: “Deeply unpopular Congress aims to pass deeply unpopular bill for deeply unpopular president to sign”

Read more:

https://www.washingtonpost.com/news/politics/wp/2017/11/29/deeply-unpopular-congress-aims-to-pass-deeply-unpopular-bill-for-deeply-unpopular-president-to-sign/

Protesters in wheelchairs are being removed from the Senate chambers.

https://twitter.com/ABC/status/935753246504865793

Senate Democrats

@SenateDems

We’re getting thousands of calls, emails, faxes & letters from Americans from every state urging us to keep up the fight against this #GOPTaxScam. We hear you. Your voices matter.

DOWNLOAD PDF VERSION

THE TWO HARDBALL TACTICS YOUR SENATORS SHOULD USE TO RESIST TRUMP’S AGENDA

The Senate minority is empowered to resist. Democrats may be in the minority, but that doesn’t mean that your Democratic senator is powerless to resist Trump’s agenda. The Senate is a peculiar legislative body, with lots of arcane rules designed to protect the minority from being trampled by an irresponsible majority.

These rules were literally designed to protect against tyranny. In short, they were made for moments like today, with a would-be autocrat in the White House and both legislative chambers controlled by Republican majorities that have so far shown themselves unwilling to stand up to the president.

This isn’t about casting noble, losing votes. This is about political hardball. Among the tools that your senators has at their disposal are two very powerful ways to slow or stop proceedings in the Senate:

-Withholding Consent

-Filibustering

I just called Stabenow’s office and urged her to both withhold consent and filibuster to slow this process down. Here is the number, if you would like to call.

Southeast Michigan Office

719 Griswold St., Suite 700

Detroit, MI 48226 (Map)

Phone: (313) 961-4330

You can also call Gary Peter’s Detroit office here.

Patrick V. McNamara Federal Building

477 Michigan Avenue

Suite 1837

Detroit, MI 48226

(313) 226-6020

Toll Free: (844) 506-7420

Corporate Democrats are getting ready to sell us out. Three Democratic Senators are considering voting for the Trump tax cuts. Waiting to see how much they can sell there votes for.

https://gritpost.com/corporate-democrats-trumps-tax-bill/

Interesting.

Trump on killing the estate tax, which could save his family $1 billion or more: “They’re obviously very rich, and they love their children, right? They want to pass on what they have … but these Democrats are being brutal”

http://nyti.ms/2i1mznw

Well, we can’t count on McCain.

McCain is a YES on tax reform: “I have decided to support the Senate tax reform bill. I believe this legislation, though far from perfect, would enhance American competitiveness, boost the economy, and provide long overdue tax relief for middle class families.”

Heading into McConnell’s ofc just now Cornyn said they’re “working hard to get the last 2 members we think we need to get” -Corker & Flake

Looks like it all comes down to Collins. Corker and Flake — remember, not running for re-election — are voting NO.

If you have friends in Maine, now is the time for them to call her local offices!

Alas the only people I know in Maine are people I know professionally so I can’t ask them to do something political. I can say that Mainers, even if they can’t figure out things like vote splitting, generally are the sort who would not punish a GOP senator for voting against something. Oh how I wish Olympia Snowe was still around though.

Corker is now a yes.

https://twitter.com/christinawilkie/status/941767532326936576

Well, the fix is in.

House lawmakers the approved the tax bill 224 to 201, after being forced to vote on the bill again after last-minute revisions were made to the Senate bill, which passed that chamber 51 to 48 early this morning.

As soon as Trump signs this disaster into law, we can all begin counting down the minutes before Washington politicians begin expressing false shock and mock concern about how giving already-wealthy individuals and corporations a $1.5 TRILLION tax cut will explode the federal budget deficit (who knew?) – thus setting the stage for dire hand-ringing and urgent calls to slash bedrock programs such as social security, medicare, and medicaid.

Plutocrats – 1

Democracy – 0

2 Trackbacks

[…] « Five simple things you can do to stop Trump’s Tax Scam […]

[…] [Information on how to push back against this horrifically cruel and poorly thought through tax bill, which is supposed to go to a vote on Tuesday, can be found here.] […]