I was tempted to tune in to tonight’s State of the Union address, if only to see all of the distinguished Republican guests in the audience, like Diamond, of hard-hitting investigative news team of Diamond and Silk, and the little boy who claims to have experienced mockery for sharing the same last name with the most corrupt and dimwitted president in American history, but I’ve decided that my time is better spent elsewhere. So I’m spending my time this evening looking into some of the more ambitious policy initiatives that we’re told Democratic members of Congress are presently crafting, from the Green New Deal being touted by Alexandria Ocasio-Cortez, to the so-called “baby bonds” that folks like Cory Booker have recently been talking about.

While Donald Trump has been spending an astounding 60% of his time not thinking at all about legislation, but live-tweeting Fox News, the Democrats, like the ones noted in the last paragraph, have been fucking busy, busting their asses to craft new laws that would not only get us Trump’s tax returns, but maybe start to undo some of the damage that’s been done over the past several decades of Republican excess, as wealth inequality has skyrocketed, and spending on things like public education have slowed considerably. Well, this evening, I’d like to share a little background on one of those ambitious plans – the “wealth tax” we’ve been told to expect from the recently launched presidential campaign of Elizabeth Warren.

While the specifics about Warren’s plan have yet to be announced, here, from the Washington Post, is the gist of what we’ve been told to expect.

Sen. Elizabeth Warren (D-Mass.) will propose a new annual “wealth tax” on Americans with more than $50 million in assets, according to an economist advising her on the plan, as Democratic leaders vie for increasingly aggressive solutions to the nation’s soaring wealth inequality.

Emmanuel Saez and Gabriel Zucman, two left-leaning economists at the University of California, Berkeley, have been advising Warren on a proposal to levy a 2 percent wealth tax on Americans with assets above $50 million, as well as a 3 percent wealth tax on those who have more than $1 billion, according to Saez.

The wealth tax would raise $2.75 trillion over a 10-year period from about 75,000 families, or less than 0.1 percent of U.S. households, Saez said…

Warren’s proposal includes at least three new mechanisms to combat tax evasion, according to a person familiar with the plan. Those are a significant increase in funding for the Internal Revenue Service; a mandatory audit rate requiring a certain number of people who pay the wealth tax to be subject to an audit every year; and a one-time tax penalty for those who have more than $50 million and try to renounce their U.S. citizenship…

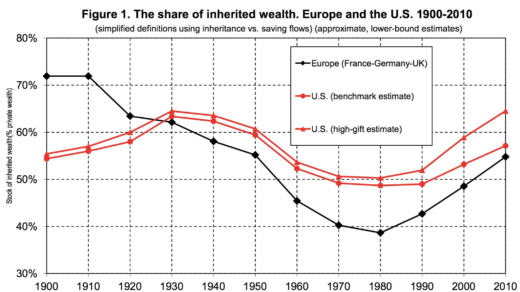

It should be noted that there are alternative ideas being floated as to how we might address the growing, and dangerous, wealth inequality we’re seeing right now in America. Ocasio-Cortez, for instance, has talked publicly about raising the income tax rate to 70% for America’s top earners. According to the analysis that I’ve read, however, Warren’s plan, as outlined above, would bring in $2.75 trillion over a ten year period, whereas the plan touted by Ocasio-Cortez would bring in only $720 billion over the same period. [And the plan being pushed by Bernie Sanders would bring in only $315 billion.] If you’re wondering why this is, the answer is pretty simple. America’s super-wealthy, for the most part, don’t work. And, as such, they don’t earn wages that can be taxed. No, most of the wealth we’re seeing today is accumulated, multi-generational familial wealth, as you can see in this graphic.

But here’s the good news. According to polling, the American people, in the wake of the last Republican tax cut for the wealthy, which, despite the promises, did absolutely nothing for the American middle class, seem ready to make a change. According to today’s Washington Post, “Sixty-one percent of voters in a new Politico/Morning Consult poll say they support a tax on high levels of wealth such as the one proposed by Massachusetts Sen. Elizabeth Warren.” In fact, according to the same poll, just 20 percent said they would not support such a tax on wealth.

For what it’s worth, the folks at Fox News were have not been as enthusiastic. In fact, they said yesterday that Warren’s program would be akin to Venezuelan socialism.

We have no way of knowing, of course, whose initiative will move forward to a vote, or whether or not it’ll attract the votes necessary to pass, but it’s exciting, after two years of living under Trump, to see Democratic legislators hard at work, gearing up for the possibility that, in 2020, we may actually have a shot to see real, significant progress made on hugely important issues like climate change and wealth inequality. I know these are difficult times, but, at the same time, there’s also a sense that, working together, we can actually make a difference, and that’s incredibly exciting.

10 Comments

The non-working inheritors of wealth are a cancer on our democracy.

If you didn’t watch the State of the Union last night, you missed Pelosi’s clapping and Joshua Trump dozing off.

https://twitter.com/kylegriffin1/status/1093132243390906368

https://www.theguardian.com/us-news/2019/feb/06/the-trump-who-fell-asleep-during-state-of-the-union-hailed-a-hero

You’re right about Trump’s tax cuts not working as promised. Did you see this today?

Bloomberg: “U.S. Banks Win $21 Billion Trump Tax Windfall Then Cut Staff, Loaned Less”

Read more:

https://www.bloomberg.com/news/articles/2019-02-06/banks-reaping-21-billion-tax-windfall-cut-staff-ease-off-loans

You know, I think Trump, in his own way, by winning in part on class rage and having the opportunity to enact his bonehead tax cuts, will pave the way for actual policy solutions to income and wealth inequality. Eventually. Right now most Trump supporters are thinking the great Obama economy we are experiencing now is because of Trump. People only pay attention to their own money. Most are doing better than before right now. That’s likely to change before 2020. We better hope it does. If the inflation and slowed growth that are coming hit with a Dem in office, we won’t get anything done.

Warren’s Plan won’t work. People that wealthy will simply move their residency and assets elsewhere. If they don’t have businesses and aren’t working, what will keep them here? Maybe the tiny percentage will dissuade them from jumping ship. We’ll see.

Focussing on AOC’s revenue generation ignores the other benefit of her progressive tax plan. It disincentivizes corporations from predating on workers and resources to extract that extra 5%. That’s important. The pressure on Corporations to meet investment return expectations would lighten up. NBusiness would need to be generative not extractive in order to grow. It’s really really important.

I’m ok with both plans if they are hard to evade. We need revenue, but we need more foundational systemic change than just revenue generation. We need to make business work for the greater good, for the general welfare. It’s possible and is the heart of democratic socialism.

The reality is that Democratic Socialism fully formed would heavily tax everyone making about the median income (but progressively). No one really wants to acknowledge that. They all want to think the ‘other’ people hold all the wealth we need to redistribute but that’s not true.

“Warren’s Plan won’t work. People that wealthy will simply move their residency and assets elsewhere.”

From what I’ve read, Warren’s plan addresses this. According to the Washington Post piece quoted above, for instance, there would be a “one-time tax penalty for those who have more than $50 million and try to renounce their U.S. citizenship.”

“one-time tax penalty for those who have more than $50 million and try to renounce their U.S. citizenship.”

This can’t be legal and she knows this. Further, the US tax reach overseas is unlike any other country in the world. Taxation, even for those who have less than 50 million in assets, is a good reason for Americans living abroad to renounce their citizenship. The US requires that people pay for services they do not benefit from when living abroad. For dual citizens, it is particularly onerous.

You don’t have to renounce your citizenship. You just have to love the assets overseas. And if you draw significant earned income— yourself.

This already happens. There is no way to prevent it that I understand.

The reality is the the wealthy are expert at tax avoidance. And they can afford the experts. There are always loopholes. And the idea that our de ocraxg eould pass such legislation without them (gove the influence of the ubercweakthy in politics) is delusion. I’d be glad, however, for her to present the idea politically and then move towards a more progressive tax structure. In Sweden everyone making over 60k /year oats an average of 60%. They get a lot for it but that’s the reality. Bernie never ran on that part of the Scandinavian model and it’s time we were honest about what kind of sacrifices the upper middle class will need to make to create a more functional and equitable country. https://taxfoundation.org/how-scandinavian-countries-pay-their-government-spending/

Recently it’s been pretty obvious the the upper middle class doesn’t consider itself the problem even while they acquire increasing wealth, housing, education and healthcare advantage . Those 1% of the 1% are handy folks to blame. I’m not excusing them. I’m also not excusing us. Waiting for their $$ to solve our nations issues orvthinkibg it can solve them all is a fantasy.

What anonymous said counters my assertion re our ability to tax foreign assets of citizens. I think it depends where those assets end up. My guess is the super rich have it sheltered v everyone else.

There are always ways to close loopholes. But there also are ways for the super rich to find new ones. I like the idea of a wealth tax but I also think we should be looking at raising inheritance taxes if our goal is to prevent multi-generational wealth.

I think one possible thing to do is to pass a law forbidding anyone who has renounced their citizenship to come into the USA legally, even as a tourist. Even for close family member funerals and weddings and such.