Rarely do I find myself getting fired-up over policy initiatives being weighed in D.C., but I just read a really interesting piece in the New Republic about the possibility that the United States Postal Service could begin providing expanded financial services, and I’m intrigued. Not only would it create a new revenue source for the USPS, but it would provide a much needed alternative to the predatory payday lenders and check cashing businesses that have had free reign to prey upon the American underclass for generations. Here’s a clip.

…(Y)esterday a new government report detailed an innovation that would preserve one of the largest job creators in the country, save billions of dollars specifically for the poor, and develop the very ladders of opportunity that Obama has championed as of late. What’s more, this could apparently be accomplished without Congressional action, but merely through existing executive prerogatives.

What’s the policy? Letting the U.S. Postal Service (USPS) offer basic banking services to customers, like savings accounts, debit cards and even simple loans. The idea has been kicked around policy circles for years, but now it has a crucial new adherent: the USPS Inspector General, who endorsed the initiative in a comprehensive white paper.

The Inspector General, who conducted the study with the help of a team of experts in international postal banking as well as a former executive from Merrill Lynch, correctly frames the proposal not as a challenge to mega-banks, but as a way to deliver needed amenities to the nearly 68 million Americans—over one-quarter of U.S. households—who have limited or no access to financial services. Instead of banks, these mostly low-income individuals use check-cashing stores, pawnshops, payday lenders, and other unscrupulous financial services providers who gouged their customers to the tune of $89 billion in interest and fees in 2012, according to the IG report. Post offices could deliver the same services at a 90 percent discount, saving the average underserved household over $2,000 a year and still providing the USPS with $8.9 billion in new annual profits, significantly improving its troubled balance sheet. The report calls simple financial services “the single best new opportunity for the posts to earn additional revenue”…

The report suggests three types of potential products. First, it proposes a “Postal Card” that could make in-store purchases, access cash at ATMs, pay bills online, or transfer money internationally. Customers with paper checks could cash them at the post office or deposit them through their cell phones, loading them onto their Postal Card. Second, the USPS could offer an interest-bearing savings account, again through the Postal Card, encouraging savings from communities with little in the way of a personal safety net. Finally, the Postal Service could offer small-dollar loans, effectively an alternative to costly payday lending. The fees on all these services would be drastically lower than anything in the marketplace today…

The following bullets come from the white paper issued by USPS Inspector General:

• “There are about 34 million underserved U.S. households, comprising more than a quarter of all American families… Being underserved often comes at a hefty price. The average underserved household has an annual income of about $25,500 and spends about $2,412 of that just on alternative financial services fees and interest. That amounts to 9.5 percent of their income. To put that into perspective, that is about the same portion of income that the average American household spends on food in one year. In 2012 alone, the underserved paid some $89 billion in fees and interest.”

• “Banks are closing branches across the country (nearly 2,300 in 2012). Although the number of closings is only a fraction of the total number of branches, the closings are not spread evenly. The closings are heavily hitting low-income communities, including rural and inner-city areas — the places where many of the underserved live. In fact, an astounding 93 percent of the bank branch closings since late 2008 have been in ZIP Codes with below-national median household income levels. This leaves some communities stranded without physical access to quality financial services, and the problem could get much worse. Banking industry experts predict that banks will continue to shut branches, particularly in small communities. Even in neighborhoods that still have bank branches, there is no guarantee that the underserved will find what they need. Less than half (43 percent) of banks reported that they actively develop products and services for underserved consumers.”

• “Fifty-nine percent of internally-managed Post Offices are in ZIP Codes with zero or one bank branch, illustrating that the Postal Service is geographically well-positioned to reach people with little-to-no access to retail banking services.”

• Apparently there’s a precedent: “(F)rom 1911 to 1967, the Postal Savings System gave people the opportunity to make savings deposits at designated Post Offices nationwide. The system hit its peak in 1947 with nearly $3.4 billion in savings deposits from more than 4 million customers using more than 8,100 postal units.”

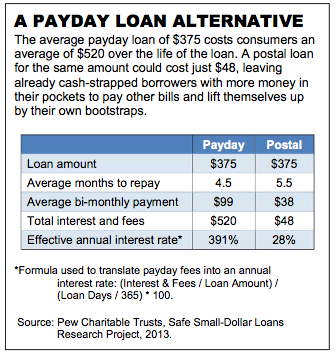

• “Here is a purely hypothetical example of how a ‘Postal Loan’ could work. Postal Loans would be available to people who have their paychecks directly loaded onto their Postal Service prepaid card (this also could be for government payments, such as Social Security or disability benefits) and have received at least two straight payments. For those whose employers do not offer electronic transfer, they could be eligible for a loan if they load at least two consecutive paychecks onto a Postal Service prepaid card. People could borrow up to 50 percent of their gross paycheck. For a person who earns $18,000 per year and gets paid twice a month, that is $375. Every borrower could be required to pay a minimum of 5 percent of their gross pay from each paycheck until the loan is paid off. In this scenario, that would be $38 from each paycheck. The Postal Service would automatically withhold loan payments from borrowers’ paychecks before putting the difference on their Postal Card. If the Postal Service charged a $25 upfront loan fee and a 25 percent interest rate, the borrower would pay off the loan in 5 1⁄2 months, paying a total of $48 in interest and fees across the life of the loan. That is less than a tenth of the fees charged for a typical payday loan of the same size. That single loan from the Postal Service could effectively put $472 back into a consumer’s pocket, which he or she could then use on more economically productive expenses.”

• “Here is a purely hypothetical example of how a ‘Postal Loan’ could work. Postal Loans would be available to people who have their paychecks directly loaded onto their Postal Service prepaid card (this also could be for government payments, such as Social Security or disability benefits) and have received at least two straight payments. For those whose employers do not offer electronic transfer, they could be eligible for a loan if they load at least two consecutive paychecks onto a Postal Service prepaid card. People could borrow up to 50 percent of their gross paycheck. For a person who earns $18,000 per year and gets paid twice a month, that is $375. Every borrower could be required to pay a minimum of 5 percent of their gross pay from each paycheck until the loan is paid off. In this scenario, that would be $38 from each paycheck. The Postal Service would automatically withhold loan payments from borrowers’ paychecks before putting the difference on their Postal Card. If the Postal Service charged a $25 upfront loan fee and a 25 percent interest rate, the borrower would pay off the loan in 5 1⁄2 months, paying a total of $48 in interest and fees across the life of the loan. That is less than a tenth of the fees charged for a typical payday loan of the same size. That single loan from the Postal Service could effectively put $472 back into a consumer’s pocket, which he or she could then use on more economically productive expenses.”

18 Comments

I neglected to mention that this is also something that’s quite common in other parts of the world.

And it’s profitable in those countries.

Job of the Future: Post Office security guard

Japan’s postal service has offered banking and investment services for years. It has worked really well, particularly for extremely rural populations.

I’m surprised it’s taken this long for the US to think of it.

Why not have them give out wheat grass shots and provide daycare while you’re at it? Nanny state. Nanny state. Communism. Obama. Hope. Change. Nanny State. The end.

For those fools who might suggest such a thing, one might remind them that the USPS has been privatized for decades.

That’s going to be too much for some people to handle, though. I’m waiting for all of the conservatives who are going to come to the aid of predatory, vampiric lenders. Disgusting.

And before I get flamed, I’m perfectly aware that the USPS is a public/private entity.

I support efforts to use the USPS and even fully public entiries to put the worst elements of our economy out of business or to improve present business practices.

This was the reasoning behind the “public option,” which didn’t happen, unfortunately.

People give the post office a lot of shit, but they handle an unbelievably enormous amount of mail each day, and, for the most part, do it very well.

The push back is beginning.

Read more:

http://www.washingtonpost.com/business/economy/expanding-financial-services-is-available-route-for-the-post-office-report-says/2014/01/27/5bd974e8-8788-11e3-833c-33098f9e5267_story.html

This from the American Bankers Association:

“The impact on banks already serving these communities would be substantial.”

and This from the USPS Inspector General’s white Paper:

“Fifty-nine percent of internally-managed Post Offices are in ZIP Codes with zero or one bank branch, illustrating that the Postal Service is geographically well-positioned to reach people with little-to-no access to retail banking services.”

means this will be an uphill battle as the puppetmasters in Washington have already planted the seed of the evil government and its unwarranted and contiuous growth being the next in a series down the path to socialism

And this made me laugh:

“We’re deeply concerned that the U.S. Postal Service is trying to drive the creation of a new [government-sponsored entity] engaged in banking services, which is not subject to the same level of regulation,”

Like regulation of the banking sector has been so successful.

If the USPS can’t compete with entities like Fedex and UPS, what makes you think they can compete with banks, or even predatory lenders?

What makes you think that they can’t compete with Fedex and UPS? They handle more than 100x the pieces of either of those two companies.

Because the USPS lost $5 billion last year, while UPS made $4.4 billion and FedEx made $2 billion.

Do you consider that competing?

Though I doubt that many members of Congress (and the mega-banks they work for) would ever allow such a thing, I think this is a great idea.

A related (good) idea is establishing state-owned banks to provide a profit-free alternative to the predatory banking industry. That left-leaning bastion of socialism — North Dakota — has had such an institution: http://banknd.nd.gov/ that acts as the repository for State funds, but also offers agricultural, small-business, and student loans.

… Also wondering if there is any way that communities such as Ypsilanti could ban (or at least discourage) these disgraceful “payday loan” and “furniture and appliances for rent” places from operating in our community.

The concerns from the American Bankers Association are legitimate, though not insurmountable. The financial services industry, including banking, is subject to extensive federal and state regulation, most of which has been enacted over the decades in the interest of “protecting the public”. If these regulations are truly needed, all businesses offering regulated financial services should be subject to them equally; if these regulations are not needed, they should be eliminated for all businesses. I like the idea of the USPS getting into financial services, but they need to do so on a level playing field with fully private companies.

I wasn’t aware that anyone had suggested that the USPS should be allowed to operate outside existing law.

I would rather get my flu vaccinations at the post office than at walgreens.