I’d heard from folks that one of the men who led the opposition to Ypsilanti’s proposed income tax the last time that it was on the ballot was planning to get involved again this time around, and I’d been standing by, patiently waiting to see how his anger would manifest itself. Well, I got my answer this morning, when I heard form a reader that a mysterious stranger had swooped in and snapped up the URL for SaveYpsilantiYes.com, which is what the pro-income tax group had been calling itself this time around. I wouldn’t normally have an issue with this, as I think the pro-income tax folks should have had the URL locked down before announcing the name of their group, but, from what I’m told, the site that you’ll now find at that address is full of “completely false” information. I haven’t had the chance to fact check it yet myself, but, if that’s the case, it’s despicable… but, to be honest, not altogether unexpected. As you’ll recall, we’ve seen stuff like this before in Ypsi.

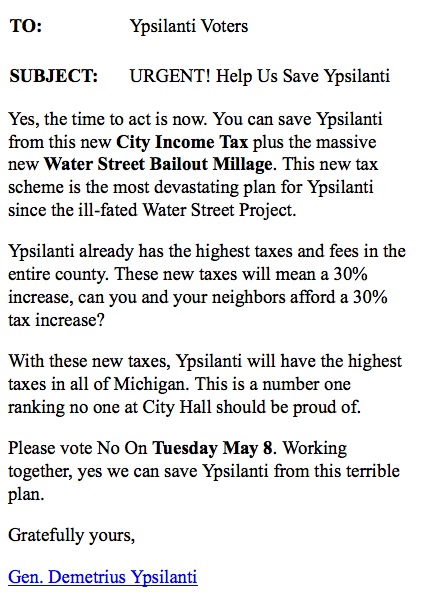

Anyway, here’s some of what you’ll find if you visit SaveYpsilantiYes.com.

The folks supporting the City income tax aren’t sitting still, though. They’ve renamed themselves Save Ypsi Yes, and they’ve just launched a website of their own.

That’s all I have time for at the moment, but I’m sure we’ll have ample opportunity to go into this in much more depth in the future… This was, after all, just the opening salvo in what’s likely to be a long, protracted, and ugly fight.

[For those who would like to know more about Ypsilanti’s current financial situation, and what’s likely to happen if the income tax doesn’t pass, I’d suggest checking out our last thread on the matter, which was pretty exhaustive.]

179 Comments

TO: Ypsilanti Voters

Start with a truthful statement. This is the key to a good scaremongering chain email.

SUBJECT: URGENT!

9 weeks? I have a different definition of urgent.

Help Us Save Ypsilanti

Who’s us?

Yes, the time to act is now.

No, the time to act is May 8th.

You can save Ypsilanti from this new City Income Tax plus the massive new Water Street Bailout Millage.

What is the new income tax proposal? What is the new massive millage proposal?

I really would like to save Ypsilanti, but without any facts you make it very difficult.

This new tax scheme

Scheme: : a plan or program of action; especially : a crafty or secret one.

-What makes you think this plan is is crafty or secret?

the most devastating plan for Ypsilanti since the ill-fated Water Street Project.

I find this hard to believe. Please supply some numbers to back up this contention.

These new taxes will mean a 30% increase,

Again, where are the numbers. 30% more than what, to whom?

can you and your neighbors afford a 30% tax increase?

How could I possible know if my neighbors could afford a tax increase? Especially one that you have obviously pulled out of your ass?

With these new taxes, Ypsilanti will have the highest taxes in all of Michigan.

Proof?

This is a number one ranking no one at City Hall should be proud of.

Both of them?

Please vote No On Tuesday May 8. Working together, yes we can save Ypsilanti from this terrible plan.

In fact it is so terrible, I won’t slip in a single actual number into the discussion. I will assume you will vote no base on the number of times i used ALL CAPS with exclamation points divided by the number of scary words times the number of bold words.

Hey, I don’t know if I will vote for this or not, but this letter doesn’t help me one bit in making that decision.

I disagree. I don’t think the debate starts in earnest until Steve dresses up like a Redcoat and rides one of his Segways through the middle of town, warning people of the impending danger posed by increased taxation. (And, yes, this did happen.)

I appreciate the very-light-grey-on-white tiny font that you have to scroll several screens down on the webpage to see. I suppose it meets the legal requirement to identify a responsible campaign committee, in a very narrow technical sense:

“(c)2012 and Paid for by the Committee for Better Government 118 S Washington St, Ypsilanti, MI 48197”

Here’s the county’s campaign finance reports for Committee for Better Government: https://secure.ewashtenaw.org/campaignfinance/userViewCommittee.do?cid=P-2002-010 (Note no filings since 2008–and probably can’t read too much into that since several of the people who appear on those filings are now open supporters of the May proposals.)

For completeness, here’s the link to the Save Ypsi Yes committee filings: https://secure.ewashtenaw.org/campaignfinance/userViewCommittee.do?cid=B-2012-01.

And, actually, it appears there’s a third active campaign committee in town, just filed last week–the Committee for a Safer Ypsilanti? Looks like they’re related to EMich Students for a Sensible Drug Policy, and are circulating petitions for a November ballot question:

Being new to Ypsilanti, and being (admittedly) a generally kind person who truly believes in “the golden rule”, this kind of stuff makes my stomach turn. I honestly don’t understand why people feel okay acting like this. I guess I (naively) thought that we were all acting like adults who honestly wanted the best for our city, whatever that might be. It’s fine to disagree, but this kind of stuff is childish and disgusting. Whomever it was that bought the domain for the express purpose of manipulating it, and posted that ridiculous “memo” should be ashamed of themselves. I just feel sorry for you that you feel the need to act that way.

I spent 10 minutes going through DNS records before realizing if you scroll down, Steve Pierce claims credit for it.

© 2012 and Paid for by the Committee for Better Government 118 S Washington St, Ypsilanti, MI 48197

I am still undecided but these types of games make it harder for me to vote no.

Who announces a web site without actually owning it?

With people like this working for and against an income tax, this town is doomed.

Break out the Popcorn,,,

WL.

As someone who lives in a Michigan municipality with an income tax (Detroit) I am a little wary of Ypsilanti’s income tax proposal. I know, it doesn’t directly impact me. Not my community. Etc. I do know this. Detroit’s income tax is lamented by many of the entrepreneurs and younger politicos here. It’s also one of the biggest excuses given by suburban business people who want to open or expand a business here but don’t. If I were King of Detroit, I would likely move to get rid of it.

I understand/appreciate the merits of a municipal income tax, specifically those that have been spelled out here and by proponents of this idea in Ann Arbor and Ypsilanti. However, I am leaning toward the idea that it would hurt more than help in the long run. It seems like a municipal income tax would only work on a regional basis where every community buys in. Limiting it to only the inner city communities does too much to balkanize this region and accelerate disinvestment in urban communities. I’m more leaning toward anti-income tax (not that my opinion really matters) mainly because I don’t see how another municipal income tax would push the region in a positive direction.

Who’s Steve got with him this time around, now that his two primary henchmen, Brian Robb and Pete Murdock, are now on City Council, and supportive of both the income tax and the Water Street millage?

It’s funny how, by the way, Brian and Pete changed their minds about the income tax once they got into power. As you’ll recall, they both ran on an anti-income tax platform.

Ah, small town politics. Isn’t it beautiful?

Steve needs to find a new headquarters also.

His prior ones are shuttered,,,

WL.

I dunno… I think I am against the city income tax as in the long run it will drive people away from Ypsilanti. Having just moved and bought a house in Ypsi about 3 years back, I had already been steered towards Ypsi Township due to the lower property taxes but ended up in Ypsi anyways and have been happy in the city but I think if there was an income tax as well I would of just moved to the Township or some place else.

There are legitimate reasons to vote both for or against the proposed income tax, and I welcome an open and honest debate. What bothers is that some people would rather obfuscate the facts in an attempt to trick people into supporting their cause. That “win at all costs” mindset, in my opinion, is not good for our city. Sadly, there are some in our community who don’t seem capable of honest debate, relying instead on ridiculously stupid tactics such as these. I’m undecided on the income tax, but I’m inclined to say that I’ll be voting for it, if for no other reason than men like Steve Pierce are against it.

@walt – The Save Ypsi Committee had the second domain that Mark mentioned registered ahead of time, http://www.saveypsiyes.com/. When the SCIT people found out about this they went and registered the spoof address in question which uses the full name Ypsilanti instead of Ypsi.

The heart of this issue is being ignored by most here. The only reason an income tax is being proposed is because the city has already levied the state mandated maximum mills in property taxes. So the city has to keep coming up with separate “line item” mills, if you will, to keep taking money from residents and people that actually work in the city.

Why don’t people here see that as an enormous problem? Why do you think this will be the solution to “save ypsi?” They will just ask for another form of tax in a year or so, to cover some other wasteful program/idea.

The heart of the issue is that the city is so mismanaged, that it can’t survive without endless specific taxes, on top of the state mandated maximum for prop. taxes. You guys keep voting to give them more and more money, and they will continue to ask for more and more and more of your money.

Can anyone speak to the specific charge that, “these new taxes will in a 30% increase”? Is there any scenario in which that would be the case, or was this number just pulled out of thin air?

the taxes will vary with each home (seems higher on the east side). It depends how long you have owned your home and which neighborhood you live in. My family would see at least a 30% increase between the millage and income tax. Some of us had lower taxes last year and some of us had higher taxes.

@wetdolphinmissile, i believe you are mistaken. Everyone in the city of Ypsilanti pays the same millage rate.

Isn’t it interesting that when people actually get educated about the real numbers, and the real reasons for the city’s financial situation, they support the proposals for new sources for revenue?

The anti tax candidates of the past now support these proposals because they have had to get educated and understand the issues. The majority of the anti-tax people simply do not understand what is going on and are falling back on theoretical positions, rather than positions based in reality.

This is not a matter of mismanagement. This is a matter of pension and healthcare costs commitments of the past growing and eating up our current revenues, and of the greater national & state economic situations “trickling down” to us to deal with. Yes, Water Street was a gamble that didn’t pay off, but complaining about that isn’t helping anything. What will help is to get this city through to the other side of this situation so that it doesn’t fall apart before the bigger systems at the federal and state level can change.

Cities will fall apart, that is inevitable. Ypsilanti doesn’t have to be one of them. When other cities start to fall, the state will have to respond and things will change with regard to municipal funding. We just have to hang on while this all happens.

Get educated. Understand this issue as more than theoretical. Our city depends on it. If you aren’t willing to get educated, then do us all a favor and stay home on May 8. If you already understand these issues than I look forward to seeing you down at the polls when you cast you YES votes.

Here is some information about how these exact same issues have impacted other cities (San Jose & Vallejo CA, for example) . If you don’t understand that this is bigger than Ypsilanti, then you don’t understand the issues.

http://www.vanityfair.com/business/features/2011/11/michael-lewis-201111

http://www.nytimes.com/2011/03/06/magazine/06Muni-t.html?pagewanted=all

When you all quit fucking around ripping on Steve Pierce, lemme know when the actual debate about the tax begins again. And here I thought this was a thread about the income tax battle, you know, considering the grossly misleading headline.

Who’s acting like an angry little man now, Mark?

Look, I don’t give two shits about Steve or the People’s Front of Judea or whatever the hell these splitter groups call themselves. Just get back to the basics. We have a comment from someone from Detroit with actual income tax experience. We have a debate about how much taxes will actually go up, but not answers. Can we focus on those things, please?

@Dan, although everyone pays the same millage *rate*, the dollar amount people pay varies, based on the taxable rate of that property. The taxable value of a property is separate (but, of course, related) from the assessed or state equalized value. The dollar amount each person pays is based on the taxable value of their property, not the assessed value or SEV, although the rate remains the same.

Let’s assume we don’t have an income tax.

Let’s also assume a person owns a home with a taxable value of $40,000.

Finally, let’s also assume that person has an AGI of $75,000.

Under the current millage rate of 62.858, this mythical person would pay $2,514.32 in property taxes.

Now let’s assume it’s the following year.

Let’s assume that same person’s home has seen a 7% decline in value making the taxable value $37,200.

Let’s assume that same person still has an AGI of $75,000.

We know the Water Street millage will add 4.7085 mils in the first year to your tax bill. We also know the increase in the F&P pension millage will add another 1.8698 mils to your tax bill making the total millage rate 69.4363.

Your property taxes on that would come to $2,583.03.

Assuming this person only has one deduction, their income tax bill would be $740.

Total taxes in 2011 = $2,514.32

Total taxes in 2012 = $3,323.03 = $2,583.03 + $740

That’s an increase of 32.2%.

Now let’s also pretend that the City will pay for half of your Water Street millage thus reducing your overall millage rate to 67.082.

Your property taxes on that would come to $2,495.45.

Assuming this person only has one deduction, their income tax bill would be $740.

Total taxes in 2011 = $2,514.32

Total taxes in 2012 = $3,235.45 = $2,495.45 + $740

That’s an increase of 28.7%.

Jackpot! Math is fun.

If I owned a house in Ypsi, that had a taxable value of 40k (80k market value) and was paying 3200/taxes for what Ypsi offers, I would walk away from my home. On the flipside, if there was no income tax increase, and the police presence disappeared due to budget cuts, and crime significantly spikes, I would walk away from my home. At some point it becomes about providing a quality life to my family, and not about saving a city. Just my own opionion. I live in the twp. I’m sure this issue (and decision) will be coming my way soon.

Anonymous, in this string of comments, blasted my two Council members for “changing their mind” on a city income tax. This is unfair. Facts have changed, drastically, since 2008; if the revenue projected then, by the tax advocates, for the city WITHOUT an income tax, had held, I think there would not now be a need for new revenue.

But city revenue has dropped. The idea facing voters in May is NOT the same idea, on the same basis, as 4 years ago. Facts have changed. I opposed the income tax then, and support one now.

One of the relevant facts that’s changed, in my opinion, is that the city manager behind the Water St fiasco is now, mercifully, gone. So some real hope of careful management of the city’s slim revenue. Another fact that’s changed: The drop in property values, with a huge drop in city income.

Finally, let’s also assume that person has an AGI of $75,000.

The median income for a household in the city was $28,610

Jackpot! Math is fun.

How about less fun, more fact.

@Bonnie,

I’m well of aware of how prop. taxes work. Thats why I included “millage rate” in my response to wetdolphinmissile.

However, the dollar amounts are meaningless when talking about x% increases or whatever. If one person sees a x% increase in their taxes in ypsi based solely on these new tax proposals, then everyone in ypsi will see that same increase. (obviously income tax would vary based on income). Point being, thats why we discuss RATES.

Brainless,

every town needs, to mention a few things here, a self proclaimed millionaire outspoken guy, riding around on a segway, in a 2 block radias, unsuccessfully runs for mayor, supports another unsuccessful major candidate, wears a red coat, seen around town looking to snap pictures and post them as GOTCHA photos, and surrounds himself with a now defunct local Business Guru as a “PUNCHING BAG.”

Come on this is good stuff.

WL.

Brian,

I’m confused. Are you for or against this tax increase?

Steve deserves better than this. You people are just jealous because you don’t have fleets of Segways that you can give your buddies rides on, and a wife who can bring home the bacon while you sit at home, on a self-wiping toilet, conspiring with the likes of Dave Curtis, on how to ruin your rivals and turn Ypsilanti into an entertainment hotbed of ridiculous Mongolian barbecue joints and full-nude dance clubs.

Nothing has changed since 2007 with regards to the efficacy of a city income tax in Ypsilanti. If anything, the city’s financial circumstances have actually improved somewhat through the leadership of Pete Murdock and Brian Robb (and over the objections of Mayor Schreiber) to rein in city spending. Because of these two folks primarily, the city enjoys a current positive fund balance of $7 Million or so, last I heard.

Since 2006 the city budget has dropped from around $19 Million per year to around $12 Million or so (I don’t have my notes with me, so forgive me if these numbers are off a bit). The fact that city services continue to be provided after a cut of 30% or so is both fairly remarkable and truly indicative of how much money ex-Mayor Farmer and ex-City Manager Ed Koryzno actually were wasting in past years.

What HAS CHANGED since 2007 is that these same two councilmembers and ex-SCIT I supporters have learned for themselves that the $30 Million” Water Street debt run up by Mayor Farmer, John Gawlas, et. al. is simply too large for the city to ever be able to pay off even after every effort had been made to trim the budget. They also learned from the experts that, even the rosiest economic scenarios combined with approval of both tax proposals, the city will STILL not be able to pay off the debt long-term!

Under the crushing weight of the Water Street debt, the City of Ypsilanti is nothing more than an insolvent debtor-in-denial casting about for money from any source to try and fill a bottomless financial hole. More taxes are not the answer to solve an insolvent debtor’s situation: municipal bankruptcy is the way to go. Better to take this step now while we have a positive fund balance to negotiate with than to wait…..

Let’s sell the parks to a for-profit prison. Then, let’s put the kids to work, fracking along the banks of the Huron. And, those that get sick can work in brothels. Ypsilanti will be flush with cash in no time.

@dr, As I understand it, bankruptcy is not an option. In the event of a default of our debt, the courts will impose taxes sufficient to pay it.

@dragon

If were going to use facts, the 2010 Census told us that if you own a home in Ypsilanti with a mortgage, your median income is $70,462.

What about my question, Brian?

Mark’s a freakin’ brainiac! I was truly wondering if he would soon “segway” from one of Ypsi’s hot button topics (Beal) to the other (Pierce) I just didn’t expect him throw them both out there during the same week! Give the man a double-word score….

@ Designated Republican

I find it so fascinating to be going “Back to the Future” with the “no new taxes” crowd using the same tactics as before; posting under various asinine pseudonyms on various social media platforms to pretend to show popular support that exists only within their own minds.

My point was that the posting was purposely using numbers meant to scare people. Which even you admit to exaggerating to gain this effect. This letter just as easily could have used a renter locked into a new year long lease who made 24k. His/her taxes would go up 1%.

Or we could use fun math and say his/her taxes went up infinitely, from 0 to 1%.

@dragon

a renter’s tax increase can not be defined in comparing pre and post implemented income tax. It’s would be division by zero, not infinity. His taxes would increase by an amount equal to 1% of his income.

my previous post should start with “a renter’s tax RATE increase”

Renters pay way more taxes than homeowners. Homestead deductions make property tax one of the more regressive taxes. By my calculations roughly half of my rent goes to pay property taxes. The half that pays for taxes could cover a mortgage and property taxes (less homestead) for a house like mine. Owning a home in Ypsi is a bad idea. Renting in Ypsi is a really bad idea (if you don’t need to GTFO soon).

@j,

good points. Your landlords non-homestead prop tax would go up, and that would no doubt be passed along to you. Add on to that, the 1% of your income that you’d be paying, and you would certainly be paying a large increase.

Is there a proposed income tax on small businesses ? If so, how much?

OK WL, you win this round…

It has nothing to do with winning. It’s just about having fun.

Gotta love this town.

WL.

Looking through the comments, it seems the golden rule for many folks here seems to be: “Whatever saves me a buck is automatically good – whatever costs me more is automatically bad.”

Meanwhile … barely a mention about what’s best for the community in the long-run, what will help to keep Ypsilanti to remain financially solvent and stable, what will help us maintain our police and fire protection, etc.

There is no doubt that this is a complex issue and — if anyone feels the need to lay blame — there is certainly plenty to go around: Wall Street, K Street, Washington D.C., Lansing … and yes, perhaps even here in Ypsilanti.

My point is this: None of that really matters right now. Our community is facing an unprecedented threat … and we are faced with a one-time opportunity to maintain essential public safety services we all depend upon, while also making sure that control of local decision-making remains in the hands of locally-elected (and locally accountable) officials — instead of an unelected, accountable “Emergency Manager.”

If that means paying a little bit more (while, in the mean time, my property tax bill continues to plummet every year), then, by all means, count me in!

If an income tax passes or whatever passes to aid in helping Ypsilanti stay a float, I have no problem paying it.

That’s where I stand,

WL.

@anonymous666

Touche.

@j

The “Yes” folks spout the constant refrain that municipal bankruptcy is not an option for Ypsilanti. No matter how many times they say this, doing so will not make it true.

Municipal bankruptcy is part of the federal bankruptcy code, and most certainly an option. It does require a level of cooperation from the Governor, and Rick Snyder is on record strongly discouraging it in favor of appointment of an emergency manager. That does not make it “not an option,” just difficult.

ex-Mayor Farmer’s $30 Million folly hasn’t left the city with easy options, despite the best efforts of Pete Murdock, Mike Bodary, and Brian Robb to rein in spending since 2008. A managed bankruptcy process (possibly facilitated by the appointment of an emergency manager) will allow the city to settle its massive debt under terms the city can actually afford without destroying itself and the few remaining residents who cannot get out.

In all likelihood a managed bankruptcy would include:

(1) a write-down (forgiveness) of more than half of the debt (perhaps as much as $15-$20 Million, with

(2) an immediate payoff to creditors of a portion of the remaining using the existing cash reserve (perhaps $5 Million if done soon) and

(3) an extended payment arrangement for the balance ($5 – $10 Million or so) over 20 years (probably funded by a debt millage).

It can be done, and the sooner the better. The city’s own experts have indicated that the income tax and debt millage only by some time, leaving the city in the same hole down the road. That is the definition of an insolvent debtor. Bankruptcy is our city’s only reasonable chance of actually having a healthy financial future within our lifetimes.

Bankruptcy can only occur if the Governor allows it (which he said he won’t) and the city is broke (which it isn’t).

City council unanimously (that’s right, unanimously) passed a five-year budget plan that preserves police, fire, support services, and general fund reserves with a city income tax and a debt millage. This is a comprehensive long-term plan that will stabilize the city’s finances. There will be no more wondering how Ypsilanti will survive from year to year. Businesses and families can continue to invest in Ypsilanti’s historic downtown, friendly neighborhoods, and college town atmosphere.

I hope voters will support Ypsilanti City Council’s five-year plan in May.

Paul Schreiber

734-277-5446

Mayor,

are you speaking on a mega-phone on a segway right now in downtown Ypsi, on Michigan ave?

WL.

Speaking of fighting over website domains and the like, I never mentioned it here, but, for years, StevePierce.com belonged to an actor in gay porn. I just looked, and that’s apparently no longer the case. The actor, whose real name was Steven J. LaPeikis, died recently, at the age of 44. I was going to joke and say that the pro-tax folks should buy the site, but it looks as though our Steve Pierce already has it.

What will the millage rate be at the end of that 5 year plan, and how much of the Water St debt will be paid off by then?

Page 16 of the online February 7 Ypsilanti City Council packet shows a 2017 Water Street debt payment of $1.7 million. Half of that would be paid out of general fund dollars, so on page 17 the city is estimating the 2017 debt millage at 6.8/2 or 3.4 mills. The principal paid in 2017 will be $3.4 million out of the total $18 million.

By law these debt payments must be made before police and fire services. So let’s support our police and fire services by supporting the five-year plan in May.

Paul Schreiber

734-277-5446

@anonymous666

Wow and thank you for that.

@J

Can you explain why renting in Ypsi is a bad idea right now? My only evidence is to the contrary but it is also anecdotal. My girlfriend and I are renting a comfortable two bedroom house and it is very affordable. We also have a small number of friends who rent around town and have yet to hear complaints. I suppose there might be issues among student housing landlords but I get the impression in general renting in Ypsi is a good option.

I feel like all this “tax” talk is somewhat missing the point. When looking for a place to live, I’m less concerned about tax as quality of life vs. investment.

If I own a home, tax valued at 100K, where I have to own multiple cars, in a boring, isolated sub, crap schools and services, who cares if I’m paying a few dollars less in tax? What is my cost of living? What is my quality of life? What am I paying? What is the return?

Ypsilanti will likely long have a higher tax rate than the farm subs. But I have a lot of friends in surrounding tax codes. When I tell them my “high tax” address, they’re jealous. They wanted to walk where I walk. They feel stuck. Realtors pushed them out of town. They bought overpriced homes in nondescript subs. They essentially live nowhere. They pay less tax by percent but more actual tax.

Can we get over the term “tax” and replace it with “investment”?

I maintain that Ypsi city has a very high quality of life vs. investment. My house is cheap. My neighbors are delightful. Amenities abound. I pay a higher percent, to be sure, but on a lower amount. Advice to those shopping for homes: what makes you happy? And what is your actual cost of living?

I love my neighbors. Walk to and home from delightful businesses. And my actual cost of living (all things calculated) is lower here than anywhere around. For the last 11 years, my family has easily managed on one car. Because we live in Ypsi. Calculate savings/cost of living.

For those, like Steve Pierce, who moved here for a fantasy castle tax island, Ypsi might not work. Mitt Romney might not do well here either. Preview castle auction.

I’ve done the math for our lower middle income family, many times over, and Ypsi is the best QOL ROI in the region.

Taxes smatches. Don’t care much. Vote quality of life folks.

Live well. Live Ypsi.

What the pro-tax people don’t want you to consider is that a business can locate a block outside city limits, where there is an excess of undeveloped property and empty storefronts, and pay half the millage with no municipal income tax and yet still be within walking distance to any amenity that the city has to offer. Higher taxes will discourage business and further depress the value of homes in the city. The quality of life is enhanced with more disposable income.

To anyone paying close attention to the “discussion” on this post and others like it, it quickly becomes clear that while anti-tax folks can cite dozens of reasons why they oppose this plan — yet what asked what they would do instead, they can only offer two alternatives:

1.) The appointment of an “Emergency Manager” – which would end Ypsilanti (and local democracy) as we know it, by having a Snyder-appointed bureaucrat take the place of our Mayor and City Council, who would have virtually unlimited powers to break contracts, terminate employees, and sell of publicly-owned assets (pools, parks, recreation centers, etc.) at “fire sale” prices — without public input, or approval.

2.) Municipal bankruptcy — which Governor Snyder has made clear he won’t allow — but which, even it *were* allowed, would simply mean that a bankruptcy judge would essentially decide which public assets could be sold off to pay Ypsilanti’s various creditors — with the Water Street bond-holders at the front of the line. Just to be clear, what this would mean is that Ypsilanti residents, taxpayers, employees, etc., would be at the absolute bottom of the list, and would only end up with whatever was left (if anything) after the banks, bond-holders, and other creditors had been paid in full.

This isn’t “fear-mongering,” these are facts. And clearly, a unanimous City Council (including a majority who ran on an “anti-tax” platform) now seems to agree.

So to everyone on here who says, “… but some people’s taxes are going to rise,” You’re right. To everyone who says, “… but some residents or businesses may get pissed off and choose to leave,” You’re right. And, to everyone who says, “… but nobody knows what’s going to happen after 2017,” Well, you’re right, too.

But given our circumstances (and the horrible alternatives), I would sure as hell rather pay a bit more to make sure that locally- and democratically-elected officials remain place to help look out for the best interests of me and my neighbors — than have some appointed bureaucrat or bankruptcy judge arrive to dismantle and sell off my community just to satisfy the wishes of some New York bankers, or some mysterious bond-holders I have never, and will never, meet.

Does anyone know if small businesses or corporations also have to pay this income tax or is just individuals?

How about a 3rd alternative? Reduce expenditures. Eliminate recycling and return to a volunteer effort. Default on the Water Street loan and renegotiate a longer repayment period. Reduce the size of the police force. Hire a city manager at half the salary of the old one. Renegotiate union contracts to more realistic and sustainable levels of salaries and benefits. Eliminate the development authorities and recapture those tax revenues for the general fund rather than use them to get matching funds for non-essentials such as elevators or clocks. Realize that economies change and consider doing things differently than they have always been done. Think outside the box – live within your current budget constraints.

If/when property values go up… is there a plan to get rid of the income tax or will it stay around forever?

“Default on the Water Street loan and renegotiate a longer repayment period.”

Wow! Thanks, EOS. Who KNEW it could be so simple?!

Somebody should really tell the Mayor and City Council about this great idea, so they can jump on a plane to NYC a.s.a.p. to begin re-negotiating our bond payments!

The plan is to pass a ballot initiative for twice the rate as needed today to facilitate the future doubling of the income tax.

Paul wrote:

City council unanimously (that’s right, unanimously) passed a five-year budget plan that preserves police, fire, support services, and general fund reserves with a city income tax and a debt millage.

Ummm, Paul, it wasn’t unanimous. You need to pay closer attention during meetings.

Looks to me that Steve got his 30% number from Brian. Maybe they aren’t on opposite sides of the debate this time after all.

Millage rate Schmillage rate @Dan. What matters is what is left over after the tax man & the insurance man rob me. And yes my property tax went up and my neighbors tax went down. ThListen to all the bragging about how it won’t cost you a thing. Which while true for some, is not true for everyone. All this while food cost goes up, health cost skyrocket, and fuel costs are rising. Bleed the turnip for more…We already pay our fair share. I fear is more people walking away from their homes as we know the renters and business will leave the city.

the 30% number looks reasonably accurate to me, even for renters who dont actually pay property tax directly, but their rent will increase due to landlord’s increase.

Thats a pretty striking figure. ~30% tax increase on the people paying by far the highest tax rates in the county.

@Brian First math games now word games

You voted with the rest of City Council to adopt the Uniform City Income Tax Ordinance and a FULL Water Street Debt millage pending voter approval on May 8th. You objected to and voted against using $3.8M in Fund Balance to reduce the Water Street millage and resulting tax by half in our five year plan.

You worked diligently over the past year to develop the five year plan and know that the loss of revenue is the major (not only) source of our deficit situation. It is the major difference from CIT 2007. Instead of projections of 3% annual growth in taxable value, we actually lost nearly 25% and projecting more losses to come. You also know that the two proposals are the only method the City has to replace those revenue losses.

Now to the Math is fun and 30% increase- Clearly these proposal are going to impact folks differently. And we can all pull up examples that “prove” our case including that many of the most vocal opponents have seen their property taxes reduced by hundreds and in some cases thousands of dollars.

Math is fun but let’s at least use a starting point that matters

So let’s start at 2008 with your example

Since that time the City taxable value has declined 25% causing a loss in revenue of over $2M annually – the root of the City’s fiscal situation.

Now let’s assume that the taxable value of your $40,000 house had already dropped $10,000 (20%) and the taxes paid in 2008 were $610 more than in 2011

1. Total taxes in 2008 = $3,124.32

Total taxes in 2012 = $3,235.45 = $2,495.45 + $740

That’s an increase of 3.6%. – .

One can play with numbers and each can figure their own tax liability, but they should also figure in the reductions in property taxes over the past several years.

The tax impact will impact everyone differently BUT the inability of the City to provide a safe and decent community will impact everyone.

The larger question is what kind of community do we want and are we willing to pay for it. We will find out on May 8th.

What do you think Pete- should the city spend hundreds of thousands of dollars annually to provide recyclable materials for Ann Arbor to sell, especially since more than 90% of recyclable materials collected in our nation ultimately ends up in landfills anyhow?

Mr. Murdock,

I fail to see why you (and others here) keep trying to paint the declining value of one’s single largest investment as a good thing. You are actually trying to say that people are just fine because their house is worth 25% less than it was 3 years ago, so they are paying basically the same amount in taxes anyhow???

thats ridiculous, and mind boggling.

Thank you, myheart claps. That was beautiful.

yes beautiful. “Taxes smatches. Don’t care much.”

unbelievable.

@ Pete Murdock

“The tax impact will impact everyone differently BUT the inability of the City to provide a safe and decent community will impact everyone.

The larger question is what kind of community do we want and are we willing to pay for it. …”

I couldn’t agree more.

Thanks for adding some logic and common sense to this discussion.

i’m a renter and i’m not going anywhere.

Mayor Schreiber’s five year plan does not solve the problem; it delays the inevitable. Despite the pro-tax side’s wonderful assertions that they will impose only 1/2 of the debt millage they are asking for in May, the plan’s details show that the millage must rise during the second five years and beyond.

Brian Robb is the only honest councilmember commenting here, as he quite rightly asserts that the scope of the financial mess should compel the city to impose the entire debt millage right away if city officials were being honest with the residents.

Instead we have the same sad and discredited argument from the 2012 pro-tax side that we saw in 2007: Vote for these taxes and we promise we won’t whack you with all of it at once! Ludicrous.

Mayor Screiber’s comment that the city isn’t broke illustrates the same attitude as the person who, upon receiving a blizzard of “insufficient funds” notices, perplexedly responds with, “But why? I still have checks left!”

Mr. Mayor, a city can be insolvent with a $7 Million cash reserve. The $30 Million debt plus the massive interest costs equal out to many times the entire annual budget of the city. Even if both tax proposals pass in May, your own experts have reported to you that all of the new revenue that may be generated will not be enough to retire the debt long-term.

That is the definition of insolvency, and this alone is an excellent reason to begin the conversations now with the Governor’s office to look for a viable alternative to this slow death spiral.

exactly DesignatedRepublican. This is just another in a long line of never ending tax increases, that only prolong the problem. In a city whose residents already pay astronomical rates.

And the thing that I just cant comprehend is how so many of the people here are fine with that. The continuous replies about how people love their half empty downtown that they can walk to so easily; that they are more than happy to pay the “luxury tax” or the “quality of living” tax, cause they have a bus stop on their corner. These people will never say no to a tax increase, as long as someone threatens to remove some of the bloated police force, etc.

I mean, if you like throwing money away so much, why not just order a Stewart Beal raised bed or 5.

Council’s five year plan is based on both of these taxes passing. They have no plan for what they will do if they do not pass. I do not understand how people can say what will and will not be cut if the taxes don’t pass, there is no public plan that I am aware of. Even with both taxes passing we are again in the negative in five years. The city has millions of dollars in reserve. They have enough to spend whatever a special election costs to have the vote in May instead of adding it to another scheduled election. The situation is not that desperate…

Huh…

I attended the meeting where the council member vote was unanimous.

My preference would be to discuss the issues instead of attacking individuals. Since we’ll be able to vote on this, I see no reason to insult people.

My two cents.

@ Emma

Sorry, but the “millions of dollars in reserve” bit is nothing less than a red herring argument being propagated by tax opponents.

The City does have funds in reserve — but that does not mean there is a big pile of cash just waiting to be spent however we wish.

In addition to having a certain “balance” that is kept on hand to cover an emergency or major unanticipated expense (as per standard practices in municipal accounting) much of that money is already committed to pay for existing obligations that will come due in the coming years.

In reality, claiming that there’s no problem because we have money “in reserve” is like thinking you’re “rich” because you have money in your checking account — before you’ve written checks to pay your monthly bills.

And, even if these reserves really *were* a slush fund we could use however we wanted … they pale in comparison to the estimated $24 million dollar cumulative budget hole we will face by the end of the five-year period — unless we develop new, sustainable sources of revenue.

@ Glen

If that money is a “red herring” please explain for everyone how those funds can be spent. New sustainable sources of revenue ARE what Ypsilani needs. What was done to create them before these taxes were proposed? How aggressively is Water Street being marketed? The rec center has been proposed and is supposed to help with development in that area. Wouldn’t it be better to wait for a year or so and see what happens there before trying to impose an unending income tax on the city? If these were short term measurers (two years maybe) I would consider it but there is NO WAtY I will vote for a city income tax under these circumstances. I do not trust that a city council who will say they neeed extra money from everyone but then hold an expensive special election to obtain this money is working in the best interests of our community.

I just read the FAQ’s for city income tax available at cityofypsilanti.com. One seems a little strange:

“5. Am I allowed a deduction from income for each personal and

dependency exemption I claim?

There are personal exemptions and dependency exemptions. A taxpayer

and spouse may claim personal exemptions. A taxpayer may claim one

dependency exemption for each dependent meeting the rules for claiming

an exemption under the Internal Revenue Code. As currently proposed, a

taxpayer will be allowed a deduction from income of $1,000 for each

personal and dependency exemption (as determined under the federal

internal revenue code). ”

Does that mean a single Ypsilanti resident with no children would have to make more than $100,000.00/year to be affected by this tax? A single person with one child would have to make more than $200,000.00? How many people in the city of Ypsilanti would really be contributing and how were the projected income tax figures in the five year plan determined?

one more:

”

7. May I claim a personal exemption even though I may be claimed

as a dependent on another person’s federal income tax return

(such as a parent or guardian)?

The City has added an option that allows a taxpayer to claim his/her own

personal exemption even though they are claimed as a dependent on

another person’s federal income tax return. This will allow certain

individuals (including students) who work part-time in the City to claim one

personal exemption without question.”

@Emma,

no, it means that if you made 50,000 and had one exemption, you would be taxed on 49,000. (so youd pay $490 instead of $500)

@Dan

Thank You.

I know I’ve said it before, but I feel it needs repeating. It does not make any sense why Ypsilanti has experienced such long suffering. Its a cute little town with good bones (if you look past all of the blight, crime, shitty schools, horrible tax rate/base.) It has a university. It is surrounded by prosperous cities/villages. It has a major hospital. It has different pockets of neighborhoods, with distinct houses. Everyone is pleasant, even if they don’t put an emphasis on bathing. It has a lake. I repeat, IT HAS A FUCKING LAKE.

Ypsi is the way it is because it has been horrible mismanaged. Propery declining values and business flight affect everywhere. We are no different. It’s so hard to understand why we should give more money to those that obviously have a horrific track record of managing it. I think I’m a pretty smart guy who thinks reasonably and logically. I can read, write, drive a car, and cook my own meals. What the fuck am I missing?

Where’s the “Like Button?”

excellent post Mr. Ferguson.

@Rodney Nanney – Once more I will try to dismiss the myth of bankruptcy as a viable option, or even an option at all. But, alas, I think it is to no avail.

Yes Chapter 9 bankruptcy exists but our ability to use it as viable as winning the lottery which also exists.

Section 109(c) of the Bankruptcy Codes sets forth four additional eligibility requirements for chapter 9:

1. the municipality must be specifically authorized to be a debtor by state law or by a governmental officer or organization empowered by State law to authorize the municipality to be a debtor;

2. the municipality must be insolvent, as defined in 11 U.S.C. § 101(32)(C);

3. the municipality must desire to effect a plan to adjust its debts; and

4. the municipality must either:

• obtain the agreement of creditors holding at least a majority in amount of the claims of each class that the debtor intends to impair under a plan in a case under chapter 9;

• negotiate in good faith with creditors and fail to obtain the agreement of creditors holding at least a majority in amount of the claims of each class that the debtor intends to impair under a plan;

• be unable to negotiate with creditors because such negotiation is impracticable; or

• reasonably believe that a creditor may attempt to obtain a preference.

First, once again, the Governor must approve any Michigan municipality declaring Chapter 9 bankruptcy. Governor Snyder has repeatedly stated that no municipality will be allowed to go bankrupt on his watch. I have personally met with State Treasury officials who have repeated the no bankruptcy pledge and removed it as an option for us to pursue.

Second, the municipality must be “insolvent” defined as:

(32) “insolvent” means….(C) with reference to a municipality, financial condition such that the municipality is – (i) generally not paying its debts as they become due unless such debts are the subject of a bona fide dispute; or (ii) unable to pay its debts as they become due;

We are not insolvent. We are trying to prevent that. We are not Highland Park that has no money to pay teachers or Detroit which has borrowed money to pay operational costs and will run out of money this spring.

Third, the end result of a chapter 9 bankruptcy or default would – after going through all of reserves and reducing municipal services to pay the debt – most likely be a court ordered millage to pay the debt obligation. Bankruptcy courts in municipal cases have almost always protected the bond holders.

That is what we are proposing now. As was done with the street paving millage, this debt should have been originally secured with a debt retirement millage with voter approval and a full discussion of the merits of Water Street project and its debt implications. The

The Water Street portion of our plan is remarkably similar to what you have proposed.

1. Restructure Loan for longer period of time – Several years ago the City refinanced these bonds by “capitalizing the interest” that delayed the payment schedule from the City and extended the length of the bonds out to FY 30-31. It added $3M plus interest to the bill. Because we have recently done that, there is no benefit to extending out a couple of years more.

2. Use Fund Balance to pay off some of the bondholders – What we have proposed is to use $3.8M of fund balance to pay off the debt. As to buying out bondholders, we have looked at that possibility, but there are no bonds callable (bonds that we can buy out) until five or six years from now. We will look at that when the opportunity arises – but without the debt millage and CIT there will be no surplus to buy them out in five or six years…

3. Extend the payment schedule over 20 years – See No. 1 but we are already at 20 years because of an earlier extension.

4. Use a millage to pay the balance – that is what we propose

So other than trying to get some relief from our obligation through a bankruptcy we cannot do and– I think we are on the same page with Water Street Debt.

I am unwilling to bankrupt the City and eliminate our ability to provide a safe and decent community to end up with a Water Street Debt millage anyway.

Now that we resolved the Water Street Debt situation – let’s move to the loss of revenue implications to the City’s ability to provide basic services. Tax Revenues have already declined $2M annually. After all the cuts and savings we have done over the last three years, we still are faced with about a $10M shortage over 5 years. Lacking revenue what operating expenditure would you suggest to cut or eliminate?

Does Brian Robb really not know how he voted? I find this disturbing.

@ Burt Reynolds

“What the fuck am I missing?”

For starters — any degree of understanding about how the situation Ypsilanti is facing has way more to do with global economics, national politics, zoning and other policies that favor new developments in cornfields over supporting existing urban communities, and Michigan’s completely broken system of funding local government — than with Ypsilanti being “horribly mismanaged.”

…hmmmm. Nope. Ypsilanti is not special. The effects you just mentioned are not localized. I’ll stick with “horroibly mismanaged.”

Don’t you all wish we could just say what we all are constantly thinking, but can’t? That Ypsi will never be nice until all the ghetto blacks and trashy whites leave?

how can you even deny it has been horribly mismanaged, when you are asking residents to pay for a $30 million vacant lot that was never truly marketed, and anyone that offered to buy part of had to fit a pie in the sky image of an urban center that had no market reality?

You just got done saying that the policies and market favor developable land. You had/have a huge developable plot ALONG A RIVER on a major road, and it’s been collecting trash for a decade. And thats not even getting into the egregious act of the city actually gambling tax payer money on it. It’s simply about the mismanagement of a huge plot of available, prime, downtown property.

A new site called Found Michigan has an article today on Ypsilanti which makes it sound as though everyone in town is behind the tax increase.

http://www.foundmichigan.org/wp/2012/02/29/ypsilanti-back-from-the-brink/

@ Dan.

How will hastening a downward trajectory that ends with the City under the thumb of an “Emergency Manager” fix anything?

What you seem to be saying is that you want to punish current residents of Ypsilanti for the “mistakes” of former City Councils.

@ Demetrius

Some of the proponents for the tax increase are the same group of people who thought that the Water Street project would be a boon to the city. Why follow their advice about getting out of debt when it was their advice that lead the city to this disaster? Current residents are paying for their own mistakes – electing the wrong individuals as stewards of the residents tax dollars.

@Demetrius

I dont claim to have all of the answers. But what I do know is, that your city has 20,000 residents, in a 4.5 sq mi area, and your operating budget is double what most surrounding communities have in much less densely populated areas, and many less residents.

I think cutting the police and fire force is probably the first thing to do. That is always the alarmest thing to say to get people to vote, but the fact is, you cant afford the service you have.

Why do you need weekly recycling pickup? Why not cut that back to bi-weekly?

Why does your city manager make ~6 figures?

My “solution” is to stop handing money over “willy-nilly” to these people, they have continually let you down. If you dont respond to their threats to cut police and fire protection, then they might learn how to live within their budget.

I get that most people that frequent here are liberal (perhaps ultra-liberal) and I am generally liberal myself. But there is a time when enough is enough. And the reality of the situation is that most residents of the city cant afford $500/year or more in extra taxes. And when you compare it to the tax rates to all of the surrounding communities, it’s completely insane.

meant “many more residents”

@ Dan, @ EOS

“your city,” etc.

I respect the opinions of Ypsilanti residents who disagree with me about these tax proposals, but can’t for life of me imagine why anybody who doesn’t actually live here would care so much about this issue … let alone waste precious time and energy blogging about it.

I think you should just have WoodStock III on the Water Street property to pay it off… or maybe get Glenn Beck to come and rant about how poor people are destroying Ypsi.

or the ICP Gathering…

i live in the community, not the city limits. Your policies and actions still affect me. When you guys were about to deny the rec center on Water St, because it didnt fit in your “grande plan” it would have meant a new rec center for one of the surrounding communities. If/when you enact an income tax, it will most likely mean companies that want to open in the area will open in the surrounding communities instead. These are just a few ways how your policies affect the rest of us.

But mostly, I just want to understand why so many people are so willing to keep giving money to the city. It really is crazy. You’re talking about millage rates approaching 70 for a city with a half vacant downtown that cant attract business, and people here are still ready to open their wallets and give more to these people.

Does anyone know if small businesses or corporations also have to pay this income tax or is just individuals? And if they do, is it on the net or gross?

Its a 0.5% income tax for people employed in the city. Additional 1% income tax if you live in the city. I don’t believe the compnay pays any more than they used too

For residents in the City the tax it is 1% on income no matter where it is earned unless their income is taxed by another Michigan City income tax then it is .5% on that income. Non-residents who work in the City pay .5% of their income earned in the City. Corporations doing business in the City pay 1% of their inccome derived from City operations.

@Demetrius,

Because an income tax affects more than just the residents of the city. Those who work in the City, and already pay taxes in the communities where they live, will be unfairly burdened and don’t even get a chance to vote on this issue. Because higher taxes merely exacerbates the problem, accelerates the downward spiral, and impacts neighboring communities.

If a corporation or small business in the city is owned by a person who lives in the city, wouldn’t that be 2 percent tax for that person since the city would be taxing both their business and them personally?

The city has lost about $2 million in revenue per year, in the last 4 years. That’s the root of the fiscal crisis facing Ypsi.

And the Governor will block any attempt to go bankrupt. So, it’s not an option. And yes, the $30 million debt for the Water Street fiasco is a huge liability, and it was a terrible mistake; but it is one that the courts and bondholders will force payment of. (Few if any of the original proponents of the Water St project are still in any decision making position, by the way).

The way I understand the law, if we try to go bankrupt, we’ll lose, but spend lots of time and lots of city dollars on lawyers.

So, clearly, things have changed since 2007. I was against a city income tax then, and am for the proposed city income tax now, and the Water St mileage too. Nearly all current members of Council were AGAINST a city income tax last time, but not they all (or all but one?) favor a city income tax. They changed their position because the facts changed: $2 million a year less in revenue is a serious fact.

The city has lost about $2 million in revenue per year, in the last 4 years. That’s the root of the fiscal crisis facing Ypsi.

And the Governor will block any attempt to go bankrupt. So, it’s not an option. And yes, the $30 million debt for the Water Street fiasco is a huge liability, and it was a terrible mistake; but it is one that the courts and bondholders will force payment of. (Few if any of the original proponents of the Water St project are still in any decision making position, by the way).

The way I understand the law, if we try to go bankrupt, we’ll lose, but spend lots of time and lots of city dollars on lawyers.

So, clearly, things have changed since 2007. I was against a city income tax then, and am for the proposed city income tax now, and the Water St mileage too. Nearly all current members of Council were AGAINST a city income tax last time, but not they all (or all but one?) favor a city income tax. They changed their position because the facts changed: $2 million a year less in revenue is a serious fact. (That’s my real name on the top of this post.)

Typo above!!! Sorry! that “not” four lines up from the end of my previous comment should be “now” !!

the Twp, Pittsfield, Superior, Milan, etc all lost similar levels of revenue from reduced property taxes.

if that is the “root of the fiscal crisis” why are none of the other municipalities asking for income taxes or debt retirement millages?

Dan,

Complex question, but here’s a partial answer that I think explains most of it: The townships you name aren’t in the same depths of fiscal crisis in large part because their infrastructure isn’t as old as ours (old stuff costs more to maintain), and they have much greater land area to tax, without the population density of a city. Apples and oranges.

@Mark H

EXACTLY! therefore, the lost tax revenue isnt the “root of the fiscal crisis.” The root of the cities fiscal crisis is the legacy of mismanagement and poor planning.

@Mark Higbee,

You shouldn’t have to spend more money policing 3.5 sq. miles than the township pays for 27 sq. miles just because the city has older infrastructure. 20,000 people in a small area is easier to police than 50,000 spread out over a large area. I don’t think your answer explains it at all.

@EOS the people who work in Ypsi and live somewhere else with an income tax, or vice versa do not pay more in income tax because of this. For example, someone who lives in Detroit (2.5%), but works in Ypsi (.5%), does NOT pay 3%. They pay 2.5% to Detroit and nothing more to Ypsi. Or if someone lives in Ypsi (1%) and works in Detroit (1.25%), they do NOT pay 2.25%. They pay 1% to Ypsi and .25% to Detroit.

If you mean that they pay property taxes elsewhere, and therefore should pay anything to Ypsi, you are missing the point that they benefit from city services while they are at work – police, fire, infrastructure for their commute and their employer’s location.

Ypsilanti PD has a case closure rate of twice what Washtenaw County does, and I have spent enough time in some of the township’s terrifying neighborhoods to know that the response time when called and the level of policing are paltry compared to YPD.

People that say that we, in Ypsi, don’t need as much policing as we have apparently don’t live here and don’t seem to understand how important it is to be able to call police and have them show up quickly (when the young man who is half way through your side window has yet to make it all the way inside your house, for instance). Or they don’t pay attention to crime reports or neighborhood reports of crime, so they thing that nothing happens in the city.

YPD was there with lightning speed *yesterday* morning when one of my neighbors came face to face with a burglar entering their home. He was caught. If we had the policing level of the township, he’d be cutting someone else’s screen this morning.

@ Dan. There is no way that anyone could have planned for a 35% reduction in revenue that no one knew was coming until at least 2007 or later.

We may be the first community in this area to face such difficulties, but the other communities that you mention will face rough times ahead as well.

We had a boom time in the 1970s/1980s when we had a lot of city staff and public safety and we felt secure due to the revenue brought in by Ford and other manufacturing and industry which has since dried up. In those days, no one understood the long-term consequences, no one thought that people would live as long or require such high health insurance costs, etc. You seem to think that the people of the past should have been smarter than anyone and everyone else in the country, and you seem to like to Monday morning quarterback this whole thing. This is a problem of world wide proportion, and it is hitting nations, states and cities in succession as the problems trickle down. The townships will feel this too, just give them a little more time.

@ Erika,

Our system of governance has been that residents pay for the services in the communities where they live and everyone who travels through or works in that community benefits. If your car catches fire while driving cross country, the local fire department will respond. If you are seriously injured in a car accident, ambulances will transport you to the nearest hospital, where you will receive life saving medical care regardless of your ability to pay for those services. We pay for roads in our state, but are not charged to drive in other states. It is simply not possible to apportion payments for every shared service in a proportionate manner to every individual who uses that service. Everybody pays for their own community and shares the benefit of other communities resources and the costs for all are distributed equitably.

For some reason, many residents in the city of Ypsilanti feel it is necessary to have a level of services that exceeds their ability to pay for those services, and then they desire to obtain funding for these services from persons who don’t live in their community. What if everybody takes this position? Should the Township be able to make city residents pay a fee every time they leave the city and drive on township roads? Should municipalities extract payment in advance from non-residents who visit? I suspect that a very small percentage of City residents actually are employed within the city limits, and many benefit from the property taxes of other communities. How can you consider it fair to charge non-resident employees when the majority of residents don’t pay for the services in the communities where they work?

It is a benefit to be able to call police when a crime is in progress and have them respond immediately, but at what cost? And if it is the choice of the majority of residents to have a very high level of service, shouldn’t it also be the responsibility of those residents to pay for the cost of the service they desire, without a requirement for non voting, non-residents to contribute?

I’m ignoring the nay sayers and doom and gloomers. Water Street could have worked out quite nicely had the bottom not fallen out of the housing market. LET IT GO!!!!

We are not declaring bankruptcy, and I, for one, give a shit about the city. That’s why paying extra each year to make sure we don’t fall under an emergency dictator doesn’t happen is ok with me. I, for one, am willing to make that sacrifice for my city.

The rest of you, who are anti-tax and feel it will drive people out the city. You first.

@megan,

I did leave. Just didn’t go far enough away to escape the grasp of the city reaching into my pockets for more of the money I’ve earned.

as I’ve said Erika, all of the surrounding communities have seen similar declines in tax revenue from the housing market collapse. Only one municipality is attempting to add an income tax and “debt retirement” millage to an already astronomical tax rate.

Therefore, it is impossible to say that the housing market collapse is the “root of the fiscal crisis.”

Also, one more thing. To those of you who are advocating “walking away” from the debt, I really hope you’re not parents (though i know some of you are). What kind of responsibility are you teaching your children, that when you make a financial mistake and you should just walk away and say fuck it to your debt.

If you are a parent, you suck at it, and your kids will probably grow up to be a drain on society because of what you are teaching them.

the problem Megan, is that the citizens of Ypsi did not make that financial mistake.

Yes, but by choosing to live in the city of Ypsi, it is understood that citizens have to take responsibility for that debt.

I suppose you are suggesting that the rest of the state take it on?

Certainly, that argument can be made, but I don’t think the matter is as simple as you imply.

Just to clarify, I left long before Water Street.

Regarding “walking away” … “financial mistake,” etc:

AGAIN: The Water Street debt is a part — but *just* a part — of the overall budget crisis.

Even without Water Street, the City was still facing a long-term, structural budget deficit that is not the result of any “mistake,” but rather, the result of a variety of factors (loss of manufacturing tax base, aging infrastructure, high legacy costs, being “land-locked,” etc.) that are not unique to Ypsilanti, but actually quite common to other, older, urban, “factory” towns across Michigan.

Then, came the Great Recession, and the subsequent implosion of the housing market, which — as Pete Murdock pointed out above — has caused a 25% drop in taxable values — and that drop continues. …

As much as some folks here want to continue denying reality — or looking for someone to blame — these are the facts, and this is the reality of the situation we now face.

But, the other thing we face is a choice:

Either we can throw up our hands, raise the white flag of defeat, and wait for our finances to unravel to the point where we end up with a Snyder-appointed “Emergency Manager,” (i.e. dictator) who will take control of the community from the residents (voters) and proceed to sell off our share community assets at fire-sale prices …

— Or —

We’ll pass these two taxes — and live on to fight another day, keeping local control of local decision-making, making sure we maintain decent police and fire protection to keep residents and businesses safe … and continuing to build and prepare for the future — including, one day, developing the Water Street property into a vital, tax-generating asset for the city.

On May 8, Ypsilanti voters will choose one of those two visions for our community’s future.

Until then, everything else is just name-calling and finger-pointing.

First, I find it fascinating that we hear again and again from many of you how this income tax will replace lost property taxes as a result of the drop in property values. Does it not occur to anyone that our houses will now plummet yet again in value in response if this passes? Nobody wants to live here even now. If they did, they would, but there are cheap houses everywhere that stand unsold. Extra tax isn’t going to help. So, before you all get excited by this “extra” revenue, it’s going to go away just as quickly. It’s basic economics. The market here will only bear so much tax. If property values have to give to get them in line, they will.

Second, two income households are getting screwed sideways by this income tax proposal. We get double-taxed here. Nobody has mentioned this (because I’m sure it’s uncomfortable for proponents to talk about). This whole thing is so very loathsome to the very people you need in this city: growing families. So, thanks for trying to screw us everybody. Hope all you singles can hang down at all the new hipster bars in town and pat each other on the back for dropping this in our laps. Must be nice to be able to bug out when you feel like it. The rest of us are stuck here with our houses.

Last (to Megan), I think your little screed on debt is cute. “What kind of responsibility are you teaching your children, that when you make a financial mistake and you should just walk away and say fuck it to your debt.” This is called “business” and that’s exactly how it works and that’s exactly what rich people teach their children. There is no moral imperative to debt. It’s a risk taken on by the lender and they know what they’re doing. It’s not like they don’t have a recourse here. If they don’t want the risk, they should stay out of the business – and yet they flock to it in droves. I would hope my own children would have the good sense to walk away from a shitty financial deal that is killing their long term prospects.

Property values are so low because Ypsilanti schools suck so much. The people who can afford to send their children to private schools do. Fixing the schools really help fix this financial problem.

Thats all part of the master plan, Brainless. You see, when the property values keep falling, citizens wont mind paying higher and higher tax rates, since you will basically be paying the same amount anyway!

Millage rates will hit 100, but hey, your house is only worth $25k now, so you’re tax bill stayed the same!

@Glen,

What makes you think that the voters have control of the community, when “dictators” gambled the voter’s money and future without their consent on a $30 million pipe dream?

@Dan,

Glen was a big supporter of the Water Street fiasco.

Dan and others are pretending that Ypsilanti is alone in facing problems and in raising tax rates to address those problems — that’s patently false. Let’s look at data, just within the 4-county metro Detroit area:

Hazel Park’s tax rate has gone up 30% since 2005

Roseville, up 29% since 2005

Dearborn, up 28% since 2005

Sylvan Lake, +25%

Ferndale, Clawson, Dearborn Heights each up +22%

Madison Heights, Inkster, Royal Oak Twp each up +17%

Allen Park, Center Line, Harper Woods, Highland Park, Warren, Garden City, Oak Park, Sterling Heights — all up in the range of 10% to 12%.

So that’s 18 cities in just the 4-county area that have already had more significant tax increases than Ypsi — most of those increases have been voted in in the last 18 months, as those communities came to the realization that we’re at: that we don’t have any other options. Out of 79 cities I pulled data for, 61 have seen tax rates increased since 2005, and I’m sure we’ll see dozens more ballot measures in May, August, and November this year.

Ypsi’s not alone in its financial difficulties, nor are we alone in coming to the conclusion that new revenues need to be one of our solutions. We’re not even alone in the size of the increase we’re looking at. Inventing allegations of “mismanagement” doesn’t change the reality of our situation.

Murph,

#1, my issue is with people claiming the fall of property tax revenue is the “root” of the cities crisis. As mentioned several times, all of the surrounding communities face the same loss in revenue. None of them are asking for an income tax and a “debt retirement” millage. It’s 100% impossible to claim a water street debt retirement millage isnt the result of mismanagement.

#2, where did you get your data from? The state website (which has thus far only posted up to 2010 rates) does not jive with your numbers.

http://www.michigan.gov/taxes/0,1607,7-238-43535_43540—,00.html

Murph, has anyone tracked the value of homes in these areas post tax increase? (And to be clear, I believe that all of the cities you list merely increased property tax, correct? These aren’t income taxes?) Has anyone tracked the value of homes in cities that enacted income taxes? It’s all just numbers unless someone can show results. We maxed ourselves out on property tax years ago when we should have been leaving a cushion for — gee… I don’t know — today?

Mayor Schreiber, why does this income tax proposal lack an end date (or some other “end” trigger)?

If we don’t pay, will you take our home? Please?

Dan, Gawlas shows up here to say some sarcastic-ass bullshit on a regular basis. I imagine his property investment skills hover somewhere around that same level. He probably makes some coin and he’s still a resident, so at least he’ll have to pay out the ass for his own errors here. Small comfort.

@EOS & Dan: what you seem to be overlooking is that Ypsi’s property tax base has a 40% hole it – EMU. That major employer in town pays ZERO in property taxes, so it sort of clouds your whole idea of how society works.

Listen, I get it, you oppose this, you left the city, you don’t even have a vote here. You don’t really have to deal with the consequences, so why shouldn’t you (and others here) enjoy this exercise in theory? Congratulations of finding some free entertainment for the day.

The reality is just what Murph and Glen and other have pointed out. This problem is bigger than you like to admit, it is coming to a township near you in the next few years, it isn’t about Ypsi per se, but about the entire economic system. Those townships have their own versions of Water Street (wasn’t there a mobile home park that was purchased in order to prevent the derelict landlords from starting anew? Who still owns that now?). The cities were hit first because they have the smaller property base and the older legacy costs, but the townships’ boom times will come back to haunt them in succession as well.

By the way, to all of the “this will drive business away!” folks: certain businesses depend on being in the city, near EMU, near the hustle and bustle. They aren’t going anywhere. The others may choose to leave, we can’t stop them. What will make EVERYONE leave is a community that is dangerous, dirty, and hard to deal with due to understaffing and lack of basic services.

Also, all of these retorts are really just ways of saying “I don’t want to pay”. That’s fine. You have to do what you have to do, but for those of us who are willing to pay to keep this city worth living in, it’s getting really frustrating to hear you repeat the same red herring arguments when what you should be saying is simply “I don’t want to pay”.

I am willing to pay. I am going to step up and keep this city whole. I am going to vote YES on BOTH on May 8.

Erika,

#1, Correct me if I’m wrong, but doesnt EMU have it’s own public safety? And aren’t the students there a good portion of the renters in the city, and thus their landlords pay prop taxes? I understand that land could be used for business tax driven revenue, but I dont see why that is really that big of a crutch? Thier student body contributes to rentals, local businesses, etc.

#2, we DO have to deal with the consequences. When homes and businesses in the city go vacant , it affects our property values as well.

#3, The township has lost plenty of prop tax revenue in the recent years. We adjust our budget accordingly. see page “vii” of the 2010 township audit.

http://ytown.org/government/township-departments/accounting/2010-financial-statements

Talk of “driving business away” from Ypsi is laughable.

One last point, since so many people seem to have already forgotten this: other communities don’t have 50% of their land mass eaten up as untaxable 40% EMU, 10% churches, the river, etc). The townships have far more property to base their revenues on. Ypsi Twp has 29 sq miles to Ypsi City’s 4 minus 2 = 2 sq miles.

Farmland doesn’t generate tax revenue to the same extent as a densely populated city. Ypsi City is closer to 4.5 – 1 = 3.5

EMU does have it’s own police, but not fire.

If you are so tied to what happens in Ypsi, then you should be worried about how the shortfalls in the budget will be made up. Reducing staffing significantly, which is required if that’s the only way to make up the shortfalls, will impact property values by destabilizing the community.

Do you seriously think that the city hasn’t adjusted to the changes? City staffing has gone from 139 to 92 (72 general fund) in the last few years. We eliminated “extravagances” such as the Parks & Rec department, we consolidated to the point that we are running on a skeleton crew of lean efficiency. There isn’t anywhere else to cut that doesn’t change our quality of life.

I am voting YES so that we can keep our quality of life while communities around us hit the wall that we have hit and have to make that choice for themselves. This is a proactive and responsible move and I applaud it.

Will the city be able to hire more people, or will it just keep in place the skeleton crews of lean efficiency?

@Walt,