Wisconsin Congressman Paul Ryan made headlines a week or so ago with his budget proposal. People in the press, as I recall, seemed impressed. They used words like, “bold” and “serious,” and praised him for making difficult decisions in order to address the nation’s spiraling budget deficit. Once people really started digging into it, though, they began to see if for what it was – a plan to extend tax cuts for the wealthy and phase out Medicare. And, now they’re beginning to ask questions. The following video was shot during a recent town hall event held by Ryan in Wisconsin. You’ll note that the man asking the question refers to himself as a conservative.

Here’s more from our friends at ThinkProgress:

During a town hall meeting in Milton, a constituent who described himself as a “lifelong conservative” asked Ryan about the effects of growing income inequality in our nation. The constituent noted that huge income disparities contributed to the Great Depression and the Great Recession, and thus wanted to know why the congressman was “fighting to not let the tax breaks for the wealthy expire.”

Ryan argued against “redistribut[ing]” in this manner. After the constituent noted that “there’s nothing wrong with taxing the top because it does not trickle down,” Ryan argued that “we do tax the top.” This response earned a chorus of boos from constituents:

CONSTITUENT: The middle class is disappearing right now. During this time of prosperity, the top 1 percent was taking about 10 percent of the total annual income, but yet today we are fighting to not let the tax breaks for the wealthy expire? And we’re fighting to not raise the Social Security cap from $87,000? I think we’re wrong.

RYAN: A couple things. I don’t disagree with the premise of what you’re saying. The question is what’s the best way to do this. Is it to redistribute… (Crosstalk)

CONSTITUENT: You have to lower spending. But it’s a matter of there’s nothing wrong with taxing the top because it does not trickle down.

RYAN: We do tax the top. (Audience boos). Let’s remember, most of our jobs come from successful small businesses. Two-thirds of our jobs do. You got to remember, businesses pay taxes individually. So when you raise their tax rates to 44.8 percent, which is what the president is proposing, I would just fundamentally disagree. That is going to hurt job creation.

I’m glad to see that people across America are finally waking up to what’s happening. This is an encouraging sign. I just hope it’s not too late.

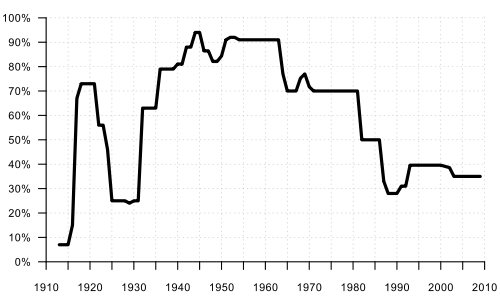

Oh, speaking of taxes on the rich, I know that we’ve talked about it here many times in the past, but the evidence would show, despite what Ryan and the Republicans would have us believe, that our economy grows faster when the wealth of our nation isn’t concentrated in the hands of the few. Coming out of World War II, the top marginal tax rate was 94%, and it stayed in that general range until 1964, when it fell to 77%. Today, it’s less than half that, and the boom that we were promised hasn’t come. Here, for those of you who are interested, is a chart showing the top marginal tax rate over time.

47 Comments

You liberals just don’t get it do you? Would it be “better” for the economy to steal money from the successful? Maybe. More money solves problems, right?!

Hell! Would it be “better” for me to rob a bank to pay my bills? Better for me maybe. Right? I think not!!!

This is about right and wrong people! “Redistribution” is just code for theft. Theft is theft whether it’s done with a mask and gun or curtain and vote.

If you can’t pay for something steal from those who can??? How many of you “liberals” leave your valuables on the front lawn and don’t lock your doors at night? Maybe if you left your savings sitting on the doorstep YOU could solve poverty.

We’re going to see more and more of this as regular Americans start to see what it’s like living in the post Fire Department and public school Tea Party utopia of America.

Income, capital gains, and corporate tax cuts in 2001 and 2003 helped revenues surge.

http://www.heritage.org/budgetchartbook/federal-government-revenues

Top earners are the target for MORE tax increases, but the U.S. tax system is already highly progressive. The top 1 percent of income earners paid 40 percent of all federal income taxes in 2007, the top 10% paid 71%, while the bottom 50 percent paid only 3 percent. More than one-third of U.S. earners paid no federal income tax at all.

Are you people too stupid to read the chart? That’s the marginal tax rate on America’s top earners. Historically speaking, taxes are very low for them right now. We are not drifting toward socialism. Read the fucking chart. And the guy in the video asking the question is a conservative. The growing wealth disparity in this country is not an issue of the left vs. the right. It’s an issue of everyone vs. the top 1% who are pulling the strings. Wake up, you tea party boobs. You’re being manipulated.

Yes, they are stupid. There is simply no other explanation. The data makes everything incredibly obvious and there is absolutely no use in discussing any of this with some folks. Carry on.

No Edward – It’s not an issue of class warfare. It’s an accountability issue for elected officials.

Talk about useful idiots….

I find it hilarious that you would call someone else a “useful idiot”. The irony is intoxicating.

72% of Americans support raising taxes on the wealthy. 78% oppose cutting Medicare.

http://www.politico.com/news/stories/0411/53455.html

Logic 101 – Bandwagon Fallacy

– AKA Appeal to Popularity, Argument by Consensus,

Argumentum ad Populum, Authority of the Many

Form:

Idea I is popular.

Therefore, I is correct.

The Bandwagon Fallacy is committed whenever one argues for an idea based upon an irrelevant appeal to its popularity.

I didn’t pay any federal income tax. They sent what I loaned them (interest free) all back to me.

I then conveniently handed my depreciated dollars over to the State of Michigan and Washtenaw County. In fact, I even threw in an extra couple of thousand dollars because I’m such a nice guy.

I agree with you EOS that just because something is popular doesn’t necessarily make it good. Sadly though we live in a Democracy, where it does kind of mater what the majority want.

Notice how EOS and his ilk WILL NOT address the chart. They simply won’t acknowledge that the U.S. hit its height of both international power AND popularity during a time of very high marginal tax rates on the rich. Not a word. They just go back to Pee Party talking points.

This is where democracy gets you when a group of people who can affect the funding of education realizes that the dumber people are the more likely they are to keep their party in office.

At some point they’ll be able to simply say ‘if you don’t vote for us we’ll let the Boogeyman out of your closet and he’ll get you!’ Oh wait, that’s “brown man,” “woman,” “gay man,” and “light brown man.”

#I’mprodeathpanel #basedonIQtesting

Reagan raised the corporate tax rate and called on corporations to pay their fair share.

http://thinkprogress.org/2011/04/18/ronald-reagan-corporate-tax/

Calling you out again, EOS et al bitches. See folks? No comment on the historical fact that the U.S. reaches its height during a time of high taxes on the wealthy. NO COMMENT. Doesn’t fit the talking points they’ve been given so they can’t say a word.

Brainless,

If you followed the previous link I posted you would have seen that I have already commented. I don’t dispute that the marginal tax rates were much higher in the 50’s and 60’s than today, but I did provide the data that the total revenues to the government were significantly greater when the top marginal rate was lowered in 2001 and 2003. Taking 90% of the next dollar you earn is a significant deterrent to earning that dollar. Retaining the incentive of keeping the majority of profits earned stimulates the economy and benefits the most.

If that’s the case, EOS, why didn’t the economy taken off like a crack fueled rocket ship once the huge Bush tax cuts passed? I’ll tell you why. The rich, contrary to what we were all told, sat on their money, or hid it out of the country. The wealth did not “trickle down”. The wealthy stayed bottled up.

You mentioned in a past thread that you were a teacher. As such, I would assume that you’d have some appreciation for American history. If you look at American history it becomes very apparent that bad things happen when wealth becomes concentrated at the top. The last time things were this bad, in terms of wealth inequality, we experienced the Great Depression. Get off the internet for a while, turn off the Glenn Beck show, and open a history book.

I’m not sure I understand you Edward. Do you think, historically, that the wealthy hide their money outside of the country less when the marginal rates are the greatest?

“Retaining the incentive of keeping the majority of profits earned stimulates the economy and benefits the most.”

You have ZERO proof of this. It’s just another goddamn talking point. You’re a fucking propagandist.

Brainless,

Did you look at the graph? That’s the evidence that supports the statement I made.

I’m not making a personal attack of you, I promoting my point of view. Could you try to do the same?

Brainless,

If you already had earned enough money to pay all your necessities and the government had set up a system that would take 90% of every future dollar you earned, do you think you would have as much incentive to keep working for that next dollar as you had to earn your first dollar when you could keep a far greater percentage?

You’re a fraud. The chart says that the nation did better when taxes were high on the wealthy. How exactly did you defend that? Don’t give me your “If the system took 90%…” bullshit. No matter what, if the laws are fair and the elections are free, I’ll live in this country and love it with all my heart. Too bad that’s not the case. If folks don’t like taxes, they’re free to leave. Yes, you can still leave the U.S. any time you want. Ain’t nobody gonna stop you. Oh, that’s right, we had MASSIVE immigration when our taxes were high. Hmmmm……

Fuck you again, you fucking fraud. You NEED to be attacked because your inability to think critically is fucking over everybody. This is not “one side vs. another legitimate side”. It’s history/reality vs. you and your goddamn talking points.

I’ll address the chart: correlation doesn’t imply causation.

If revenues were greater when taxes fell, what aspect of higher tax rates would have caused the boom?

It leads one to consider that there are other factors that lead to boom times than top marginal tax rates, and tax revenue.

EOS’s argument is rather silly. She makes her claims based on a neo-classical idea that people won’t enter businesses without the reward of profit. She ignores the neo-classical idea that, where there is a dime to be made, there is someone to make it.

Clearly, taxes have never impeded business growth in any of the large industrial economies of the world. Germany, the US and most of the powerhouses of the European continent have maintained high tax burdens while hosting some of the largest business ventures in the world. Business ventures do not care about taxes. It is merely another cost that has to be rolled in to general expenses. If you don’t go after that dime, someone else will.

Existing businesses, of course, will resist having to pay more money tomorrow, than they do today, for clear and obvious reasons. However, if you believe in neo-classical economics, businesses will adjust or fail and if they fail, someone else will come in to take advantage of the market. Assuming you believe in neo-classical economics.

Moreover, the subsequent lowering of marginal tax rates after an economic bubble has never resulted in a grand rebound of an economy. Japan and the US are both excellent examples. Japan, post bubble, attempted to stimulate the economy, by lowering the marginal tax rate of corportations. It didn’t work and hasn’t to this day.

I am no economist, though,, nor do I claim to be.

So why does everyone think EOS is a woman?

Is there evidence to the contrary? Why would we assume she’s a man?

We could assume that she’s both and be half right, I suppose.

Comrade Barack Obama couldn’t be anymore proud of Clarke could he?

1. Hansen Clarke has aligned himself with the Communist Party:

http://gulagbound.com/15771/red-reps-8-hansen-clarke-michigan-freshman-congressman%e2%80%99s-hard-core-communist-connections

2. http://www.blogslucianneloves.com/Forum/?Thread=ULGBNPUIHT104435PM

Delete

Liberals and their entitlements are lost in the ozone because they just don’t want to have to go to work for a living instead of living off the government and the taxes collected by the working person:

http://weaselzippers.us/2011/04/22/cbs-news-poll-americans-oppose-raising-debt-ceiling-by-2-1-margin/

EOS, the real incentive behind high marginal tax rates is that it forces very wealthy individuals to role their profits back into productive activity rather than taking the money out of the economy as personal income. If I don’t role this profit back into business I give it to the government. As was pointed out, people are all about making money. The question is what do you do with the money you make. Well ever since Abraham Lincoln, progressives have said, “you make obscene amounts of money—we let you do that—you have an obligations to act responsibly with the money ie. invest it in R&D, build new private infrastructure (Carnagie gave us libraries, sports team owners used to pay for their own stadiums etc. etc.). The lowering of the marginal tax rate destroyed the incentive of the ubber-rich to reinvest in our economy. The deindustrialization and ultimate destruction of the “American way” is the direct result of the Bush/Obama tax cuts.

Wait… how did high marginal tax rates make Carnegie a philanthropist? This is getting interesting.

Blake Jake, I guess you don’t use the charitable giving portion of your tax return. There is no limit on the amount of charitable giving and it is a dollar for dollar deduction from income.

It is very simple, The next million dollars I made that pushed me into the next higher tax barcket, I’ll donate away rather than letting that socialist run hell hole in Washington tell me how I spend my money.

The proliferation of foundations and philanthropic organizations in the 20’s was the direct result of “progressive” taxation. An accountant by the name of Montgomery (Montgomerybontanical.org) became ubber-wealthy him selve educating the “captains of industry” such as Ford, Edison, and others–“The Henry Ford” “Colonial Williamsburg” and so many other cultural attributes were the direct result of high marginal tax rates. As we have flatted the tax rate, the incentive to be “philanthropic” lessens. Instead of spending their money on creating culture, now they buy cheap politicians. Eh, it worked for the ubber wealthy back in the 1890’s (note how we refer to that period as the “Robber Baron” era vs. the “Captains of Industry” we called the 1920’s industrialist.

If you note the above chart, when the highest marginal tax rate fell from 70% to the mid 20’s in the mid-1920’s, the wealthy and ubber-wealthy immediately took that money and engaged in a speculative stock market bubble that ultimately crashed destroying not only some of their wealth but every one else as well. It is basic (ok, maybe more than basic) economics and psychology and sociology at work.

You can count on people to behave selfishly but not beneficently

Jake,

You’re absolutely right. Correlation doesn’t imply causation and there are plenty of other factors to consider than just marginal tax rates, and tax revenue.

Peter,

I am relying on classical economic theory. Here’s a link to a discussion of why, during the last two decades of the twentieth century, more than fifty nations significantly reduced their highest marginal tax rates on individual income.

http://www.econlib.org/library/Enc/MarginalTaxRates.html

The world’s twenty fastest growing economies either had low marginal tax rates to begin with or cut their highest marginal tax rates in half between 1979 and 2002. Contrary to your statement, I believe high marginal taxes have impeded the economic growth of western European nations,

From the source I cited: “Federal Reserve Bank of Minneapolis senior adviser Edward Prescott, corecipient of the 2004 Nobel Prize in economics, found that the “low labor supplies in Germany, France, and Italy are due to high [marginal] tax rates” (Prescott 2004, p. 7). He noted that adult labor force participation in France has fallen about 30 percent below that of the United States, which accounts for the comparably higher U.S. living standards.”

Mark,

I have to admit that in my usual reading sources I rarely come across views that suggest high marginal taxes are a benefit to anyone but a government that seeks to expand its role and influence. However, here’s an interesting link that is in direct opposition to the one I just cited.

http://www.alternet.org/economy/106979/why_the_economy_grows_like_crazy_amid_high_taxes?page=entire

This article states that low taxes create an incentive for profit taking and a short-term outlook. Selling subprime mortgages, trading in derivatives, packaging mortgage-backed securities and “flipping” condos were all very profitable but did not create wealth.

Proponents of this view argue that if a businessman uses his wealth for short term personal gain the government should discourage this activity by confiscating the bulk of the profits and redistributing it as they deem appropriate. However, rolling profits back into the company as a means of preventing the government from taking it in excessive taxation is a short term vision as well. When the businessman decides to retire, he loses the fruits of his labor to government when he sells the now larger business. Rolling the profits back into the business has merely provided the government a larger grab. It does not benefit the private individual and is ultimately a disincentive to business growth.

Corporate foundations are another means of allowing the businessman whose efforts generated the profits to have some control over how those monies are spent. The foundation can hire numerous friends and family members at high salaries in administrative positions. The foundation can support charities of the person’s choosing and can have some influence in society, however, it’s still a forced redistribution.

We were a nation that established government to serve the people, but now the people are used by the government to their own ends. There’s no way for the individual to win which explains why most of us are content to work our 40 hours a week to enjoy the most leisure possible.

I stand w/ Peter…I am giving a lot of what I get back from feds to the state and next year…more. In fact I am feeling taxed to death. Yes, I do want on that bandwagon that wants to tax the wealthy, no more corporate welfare, let them pay their fair share!

You might want to double check and cross reference the dates here, Mark:

http://en.wikipedia.org/wiki/Andrew_Carnegie#1901.E2.80.931919:_Philanthropist

http://en.wikipedia.org/wiki/Sixteenth_Amendment_to_the_United_States_Constitution

State and local taxes are routinely ignored, as if to say that anything goes.

I would wager that the level of corruption, cronyism, nepotism and the misuse of funds is, dollar for dollar and pound for pound, much greater on a local level than at the federal level.

It’s not the teachers, it’s the guys in suits awarding construction contracts that you have to watch out for.

I say that with absolutely no evidence. Please feel free to defend state and local taxation.

While my above comment is awaiting moderation, I’ll sum up: the first peacetime income tax in the US was the Wilson-Gorman Tariff Act of 1894 (2% on incomes over $4,000 at the time). The income provision was struck down as unconstitutional in 1895 — one year later.

The 16th Amendment, which legalized income taxes as we now know them, was not ratified until 1913.

Carnegie wrote the Gospel of Wealth in 1889 (before the Wilson-Gorman Tariff Act). The first Carnegie library opened in 1883 (before the Wilson-Gorman Tariff Act). He did most of his philanthropy in the early years of the 20th century, after the Wilson-Gorman Tariff Act’s income tax provision was struck down, and before the ratification of the 16th Amendment in 1913.

So you’re going to have to explain to me again how high marginal tax rates made Carnegie a philanthropist because when he was a philanthropist, there wasn’t any income tax at all. Somebody correct me if I’m reading it wrong.

Dolphin and Peter,

I used my State refund to pay the Feds. Maybe once it’s taken from our paychecks the system ensures. by whatever means necessary, we never see it again. ;-)

Furthermore, the airplane was invented in 1903.

If we accept that the correlation shown by the above graph implies causation, we can safely conclude that not having any federal income tax at all leads to both private philanthropy by the rich, and the invention of airplanes.

You couldn’t have just posted that earlier? Sheesh.

Aug. 5, 1861

On this day in 1861, in order to finance the Civil War, President Abraham Lincoln signed the Revenue Act, imposing the first federal income tax in U.S. history.

Before asking Congress to act, Lincoln sent letters to cabinet members Edward Bates, Gideon Welles and Salmon Chase requesting their views as to whether the president had the constitutional authority to “collect [such] duties.” The president also expressed concern about the potential need to replace revenue from ports along the Southeastern seaboard, which he feared might fall under Confederate control.

The Revenue Act defined income as gain “derived from any kind of property, or from any professional trade, employment, or vocation carried on in the United States or elsewhere or from any source whatever.”

In keeping with current levies, Congress based the tax on the principle of a graduated, or progressive, payments schedule. It imposed withholding at the source. Individuals earning between $800 and $10,000 a year paid taxes at the rate of 3 percent. The comparable minimum taxable income in 2009, after adjustments for inflation, would be about $19,000. Those with incomes of more than $10,000 paid taxes at a higher rate.

Like I said:

… the first PEACETIME income tax in the US was the Wilson-Gorman Tariff Act of 1894 (2% on incomes over $4,000 at the time). The income provision was struck down as unconstitutional in 1895 — one year later.

The Revenue Act of 1861 (designed to pay for the Civil War) was replaced by the Revenue Act of 1862, which ‘was explicitly temporary, specifying termination of income tax in “the year eighteen hundred and sixty-six”.’

So, again, there was no income tax at all when Carnegie was a philanthropist. Even when there were temporary income taxes both during the Civil War, and in 1894, they were very small — in the single digit percentages.

Please try again.

Which state is the best place to locate your place of work to do business and which is the least favorable state to do business. Where is your state on this one?

http://therealrevo.com/blog/?p=44172

There is no correlation between taxes and prosperity. There is a direct correlation between taxation and morality. Taxation is theft by “federal government” from its people unless proven otherwise.

States and municipal governments have the right to assess taxes based on their interests. Those debates should happen at local levels. The federal income tax is a crime against the foundation of America and an annual aggressive assault on its citizens.

The federal tax system should be based solely on tariffs. Tax imports and witness the rebirth of American manufacturing which is the fundamental base of jobs, wealth, and national security.

The liberal elite is more concerned with getting their low cost French wines at “Trader Joe’s” and driving their Subarus to Yoga class than protecting American jobs. They drive imports to their “buy local” parties and “network” on imported electronics.

Abolish the federal income tax! Tariffs on imports, including foreign oil!!! Problems solved.

Best video you’ve had on the site since, “Something’s in my ass.”

http://markmaynard.com/?p=9627

It’s heating up. Paul Ryan had to run away from a group of angry old people in Kenosha under police escort.

http://www.msnbc.msn.com/id/42772460

One Trackback

[…] more about Ryan, is some great footage of him being booed by his constituents for proposing that welfare programs be cut in order to make further tax cuts for the wealthy possible. This entry was posted in Politics, Uncategorized and tagged Andrea Saul, Massachusetts, Mitt […]